0%

What happens when disaster strikes your business?

Most small business owners think it won’t happen to them. Until it does.

The reality is harsh: 40% of small and medium-sized enterprises never reopen after a major disruption. They don’t pause or bounce back—they vanish. Of those that do reopen, many collapse within a year, unable to recover from the financial and operational hit.

Yet only 20–30% of SMEs have a written business continuity plan. In 2020, more than half of companies worldwide operated without one. That’s like driving without insurance—reckless and unsustainable. One storm, cyberattack, or supply chain failure can erase years of work in days.

Downtime is brutal. Every hour offline drains revenue, frustrates customers, and dents your reputation. Payroll stalls, orders pile up, and loyal clients drift away. Without a business continuity plan (BCP), you’re gambling with your livelihood. The house always wins.

Here’s what many miss: a BCP isn’t just about survival—it’s advantage. While competitors scramble, you stay online. Companies with tested BCPs recover faster, adapt quicker, and come out stronger.

Don’t wait—the time to prepare is now.

Cyberattacks are sharper, storms are wilder, and supply chains are shakier than ever. The threats aren’t slowing down—they’re multiplying. A single ransomware attack can lock you out overnight. Floods, wildfires, or power outages can halt operations in minutes. Even one supplier going offline can ripple through your business and stall growth.

Each disruption carries a heavy price: lost revenue, frustrated customers, shaken trust, and reputations that may never fully recover. For many small businesses, one incident can wipe out years of progress in days.

That’s where a business continuity plan (BCP) comes in. A BCP is a documented strategy that outlines how your business will continue critical operations during and after disruptions. It keeps payroll running, orders moving, and customer service alive when everything else is falling apart. It gives teams direction, reduces chaos, and often determines who recovers and who disappears.

In 2025, a BCP isn’t optional—it’s expected. Regulators, insurers, and partners demand it. Customers won’t wait for excuses. Companies with tested continuity plans uncover hidden risks, build team trust, and recover faster. A BCP doesn’t just protect your business—it makes it resilient.

A business continuity plan (BCP) doesn’t have to be a massive binder. For small businesses, simplicity and clarity win. The goal is to outline how you’ll keep operating when things go wrong—and how you’ll bounce back quickly. Here’s a practical sample plan any small business can adapt.

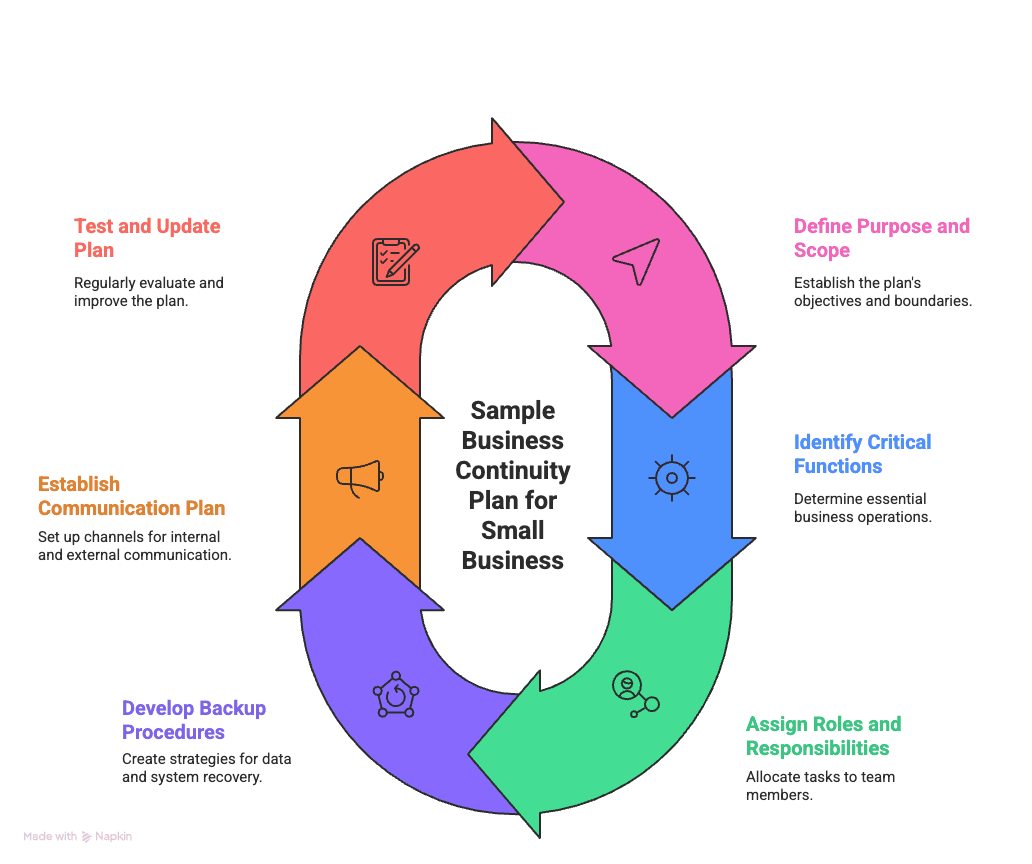

This plan covers six key areas:

Business Continuity Plan for Small Business

Let’s get into each of these to see how they help a small business stay resilient.

This plan ensures that [Your Business Name] can continue serving customers and protecting critical assets during disruptions such as cyberattacks, power outages, supply chain failures, or natural disasters. It covers all core business functions and applies to every employee, vendor, and partner.

These priorities reflect what keeps revenue flowing and employees supported.

Fast, transparent communication protects trust.

Conduct tabletop drills twice a year to make sure the plan works and everyone knows their role. Review results and update contact info, vendors, and procedures as needed. Perform a full review annually, and after any major incident, to keep the plan current and actionable.

This sample shows how even a small business can stay resilient. Clear roles, defined priorities, and tested procedures mean your company can take a hit and keep moving. That’s the difference between shutting down and staying in the game.

You can’t protect everything. The key is knowing what actually keeps your business running. Most small business owners try to save it all—and fail. A focused, actionable plan is what separates businesses that survive from those that don’t. Here’s a practical example of how a small business can prioritize and protect what matters most.

Start with a business impact analysis (BIA). Ask: “What happens if this stops working?” Identify essential operations like order processing, customer service, payroll, and system access. Map out dependencies—people, systems, facilities, and vendors—and set realistic downtime limits. Focus on what directly generates revenue and keeps customers happy. Everything else is secondary.

A small business continuity plan must account for tangible consequences:

This ensures resources go where they matter most, balancing both regulatory obligations and customer expectations.

Determine your minimum essential staff for each critical function. Maintain a skills inventory so backups are ready if key people are unavailable. Clearly define who leads during a disruption and who handles specific responsibilities. Even small teams benefit from defined roles and cross-training—it eliminates guesswork when every minute counts.

Define how quickly each function must resume. RTOs prevent wasted effort on low-priority tasks and keep the team focused on the functions that actually move the needle for the business.

A BCP doesn’t need to be a massive binder. Simple, clear, and tested plans work best. Assign responsibilities, outline procedures, and keep the plan updated. Focus on actionable steps that ensure your business stays operational when disruptions hit.

Stop trying to protect everything. Protect what matters: critical functions, essential staff, and realistic timelines. When disaster strikes, a targeted, well-executed BCP is the difference between shutting down and staying in the game.

Survival isn’t just about having a plan. It’s about having a backup for your backup. Your recovery strategy is what separates businesses that bounce back from those that become cautionary tales.

Speed matters more than perfection. Two numbers define whether your business survives:

If your online store goes dark for two hours and your RTO says that’s your limit, missing it means serious losses. Nearly 43% of small businesses never reopen after a disaster, and 29% more fail within two years even after restarting.

Faster recovery costs more upfront. Not every function needs the same downtime tolerance. Focus on critical operations first—like order processing or payroll—while less urgent tasks can wait. Align your RTOs with business priorities and your budget, not your wishlist. This way, you recover efficiently without overspending.

Your weakest supplier is your biggest vulnerability. Don’t assume they have a plan. Do this now:

If your systems are ready in three hours but your main supplier takes four, you have a risk gap. Either accept it or find alternatives.

Even with the fanciest recovery systems, sometimes all you need is pen and paper. Manual workarounds keep operations alive until normal systems return.

Focus only on what’s essential in the first 24–48 hours. Document it, test it, and update it regularly. These simple processes could be the difference between staying open and closing your doors for good.

A BCP isn’t a theoretical document. It’s a practical roadmap for survival, combining speed, redundancy, and simple contingency actions. Get it right, and your business isn’t just prepared—it’s ready to thrive, even when disaster strikes.

When disaster hits, even the best business continuity plan fails if your team can’t talk to each other. Communication is the lifeline that keeps operations alive, customers informed, and vendors coordinated. A clear, structured plan ensures no one panics, no message is lost, and critical information flows fast.

Here’s a simple communication template any small business can use:

Primary: _______________________

Secondary: _____________________

Backup: ________________________

| Role | Name | Contact Info | Responsibilities | Backup |

|---|---|---|---|---|

| Incident Lead | ______ | ______ | Activates plan, coordinates team | ______ |

| Communications Lead | ______ | ______ | Sends internal updates | ______ |

| IT Contact | ______ | ______ | Maintains system access | ______ |

Contact method: ______________________

Frequency of updates: __________________

Pre-written messages/templates: ________

Key contacts: __________________

Communication method: __________

Notification timeline: __________

Emergency services contacts: _______

Community emergency plans: _______

Building access/info to share: _______

Test frequency: _________________

Last test date: _________________

Notes for improvement: __________

A filled-out template ensures your team knows who communicates what, when, and how. Customers, vendors, and partners stay informed, trust is preserved, and operations keep moving. Test it regularly and update it as things change. Clear communication keeps your business running when everything else is in chaos.

Creating a business continuity plan is only the first step. A plan on paper does nothing if it hasn’t been tested or updated. The uncomfortable truth: most untested BCPs fail when you need them most. In fact, 88% of companies test their plans because they know preparation is survival. Testing reveals gaps, builds confidence, and ensures your team can act when chaos hits.

A plan sitting in a drawer won’t save your business. Exercise it regularly. Start small with tabletop exercises—low stress, high learning. Run focused drills on critical functions like IT recovery, payroll, or order processing. Then scale up to full simulations involving the entire team. Expect mistakes and hiccups. That’s the point. Discovering weaknesses now prevents disaster later. These exercises build muscle memory. When a real crisis hits, your team won’t be flipping through manuals—they’ll respond instantly, confidently, and in sync.

A BCP isn’t “set it and forget it.” Review it at least quarterly. Staff, suppliers, and operations change. Assign someone to own updates. After every drill, jot down what worked, what didn’t, and what needs attention. Even a focused two-hour discussion with key people can put most companies’ preparation to shame.

When a disruption occurs, don’t just move on. Within two weeks, analyze what happened. Document the facts—no blame. Identify what needs fixing with real deadlines. Update your plan based on these lessons, making it smarter and more actionable.

Your business continuity plan is a living document. Each drill, each incident, strengthens it. The goal isn’t perfection—it’s preparation. When real chaos strikes, your team will act without hesitation—and that’s exactly what keeps your business alive.

A business continuity plan isn’t just about surviving disasters—it’s about thriving when others stumble. Companies with tested BCPs are far more likely to maintain operations, protect revenue, and even seize opportunities while competitors scramble. That’s not luck—it’s preparation in action.

Resilience looks like this: lower financial losses during disruptions, stronger customer trust, better credibility with partners, and improved insurance terms. While others panic, your team executes with confidence, coordinated and calm.

The approach is simple: Plan. Do. Check. Act. Run drills, refine processes, and repeat. This isn’t a one-time effort—it’s ongoing fitness for your business. Like any skill, resilience grows stronger with practice and repetition.

A strong BCP doesn’t just restore operations; it turns disruption into advantage. Businesses that invest in continuity don’t just bounce back—they grow, capture market share, retain loyal customers, and solidify their reputation.

Disasters won’t stop, but the difference between surviving and thriving comes down to preparation, clarity, and practice. A well-maintained BCP isn’t merely a safety net—it’s your competitive edge, a growth engine, and the foundation for long-term success.

Take control of compliance, reduce risk, and build trust with UprootSecurity — where GRC becomes the bridge between checklists and real breach prevention. → Book a demo today

Senior Security Consultant