0%

Think your business is handling customer data correctly? Think again.

A staggering 92% of companies were still unprepared to meet CCPA requirements by the end of 2022. If you’re one of them, you’re sitting on a ticking time bomb.

And here's the kicker: since 2023, California’s Attorney General no longer gives businesses a 30-day warning before issuing penalties. One slip, and you could be hit with fines immediately—$2,663 per unintentional violation and $7,988 per intentional one. These aren’t flat fees. They stack up per customer. That means a single mistake with 10,000 California users?

You could be looking at millions.

But the risk isn’t just legal. Customers care, too. 94% of organizations say buyers will walk away from brands that don’t handle personal data responsibly.

The CCPA isn’t just about California anymore. Other states are copying it. If you’re not compliant, you’re not ready for what’s coming next.

The good news? CCPA compliance is more than just protection—it’s a business upgrade. Let’s explore why.

CCPA compliance isn’t just a box to check—it’s a strategic advantage.

When you get it right, you gain visibility into where your customer data lives and how it flows. That means fewer blind spots, better security, and less risk of a breach (or an expensive cleanup). It also helps eliminate bloated data storage, cutting down operational costs.

But here’s the real payoff: customer trust.

In an age where consumers are hyper-aware of how their data is used, respecting their privacy sets you apart. They’re tired of vague policies and shady practices. Show them you care, and they’ll stick with you. Ignore it, and they’ll move on—fast.

CCPA compliance also gives you a head start as other states roll out similar privacy laws. Build your systems right now, and you're not just meeting California’s rules—you’re future-proofing your entire operation.

Bottom line? This isn’t just about avoiding fines. It’s about building a company your customers actually want to buy from.

You’ve got nothing to hide—and everything to gain.

Let’s cut through the jargon—here’s what the California Consumer Privacy Act (CCPA) really demands from your business.

You’re on the hook if:

Pro tip: You don’t have to be based in California. If you serve California residents, the law applies.

CCPA has a broad definition. It includes:

It also protects “sensitive personal information” like race, exact location, and private messages—this gets extra protection under CPRA.

California residents have six major rights under CCPA (and CPRA updates):

While both laws protect personal data:

If your business operates globally, planning for GDPR CCPA compliance together can reduce redundant work and ensure smoother audits.

Understanding these basics is the first step to avoiding penalties—and building customer trust.

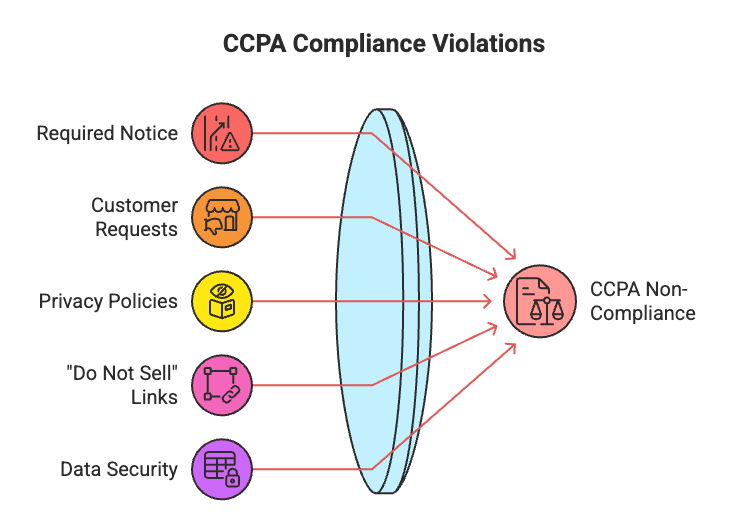

Even well-meaning businesses stumble when it comes to CCPA compliance. Here are the most common (and costly) mistakes:

Skipping the Required Notice

Mishandling Customer Requests

Weak or Outdated Privacy Policies

Broken "Do Not Sell" Links

Poor Data Security

CCPA Compliance Violations

Let’s break down each mistake and what it could mean for your business.

Many businesses forget to notify users at the point of data collection. You must clearly state:

Real-world example: A link-shortening tech firm was penalized for hiding its data-sharing practices. Even COVID-19 scheduling platforms got flagged for confusing users about data usage.

CCPA gives users the right to access, delete, or opt out of data sharing—and businesses must respond within strict timeframes.

Common missteps:

Example: A health service deleted data instead of answering a simple "what info do you have?" request. A social platform received violations for ignoring access requests entirely.

During a 2024 sweep, nearly 30% of websites had flawed privacy policies.

Common issues:

Many companies botch the opt-out experience.

Fails include:

CCPA mandates “reasonable” security—but most don’t meet the bar.

Frequent failures:

Bottom line: bad security isn’t just a tech issue—it’s a compliance liability.

Want to know if you're in trouble? Let's find out.

60% of businesses unprepared for privacy regulations means you're probably one of them. Better to catch problems yourself than wait for regulators to find them first.

Time for some honest self-assessment:

The CPRA amendments changed the game. You can't just fix things once and forget about them. Businesses must continually monitor compliance rather than relying on cure periods.

Here's what you need to dig into:

Are you keeping data longer than you need to? The CPRA requires businesses to disclose retention periods for each category of personal information. If you can't answer that question, you've got work to do.

Your site is the first thing regulators and customers see. That makes CCPA website compliance a critical front line in your overall privacy strategy.

Test these:

Your response systems must acknowledge requests within 45 days—with possible extensions up to 90 days for complex cases.

Think you can just ignore CCPA and hope for the best?

Ask Sephora how that worked out.

We already told you about the fines. But here's what that actually looks like in real life:

Got 50,000 California customers? One screw-up could cost you $125 million.

That's not a typo.

Real businesses. Real penalties. Right now:

California's Attorney General isn't messing around. They're doing enforcement sweeps across retail, travel, and fitness industries.

Fines are just the beginning. You'll also face:

The new California Privacy Rights Act cranked up the pain:

Here's the kicker: You're now liable for your vendors' mistakes too. Their screw-up becomes your penalty.

California is just the beginning. Other states are watching. They're copying these laws.

Fix this now, or pay later. Your choice.

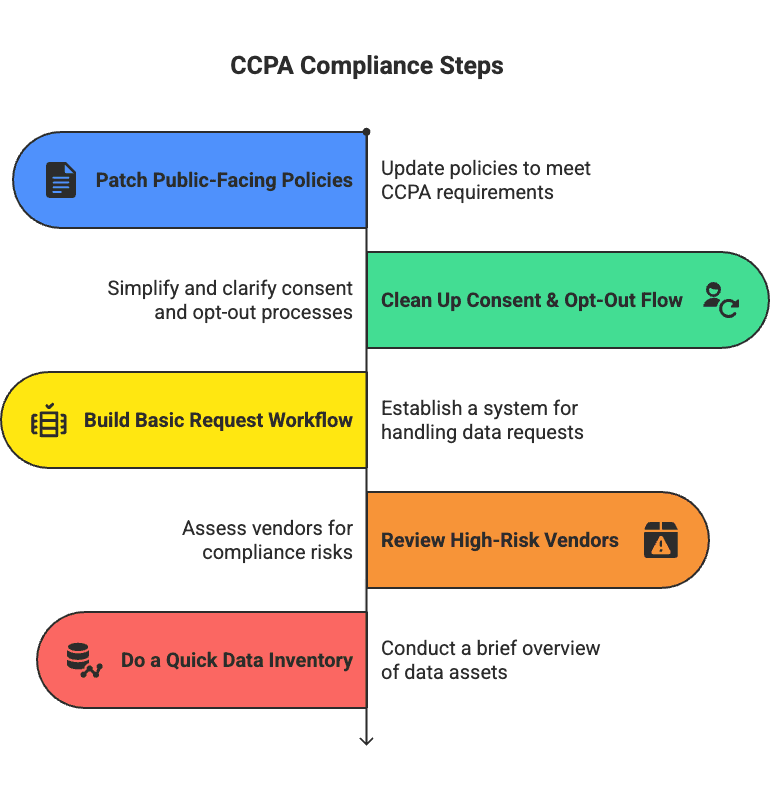

Realized your business might be out of step with CCPA? Don’t panic—just act fast.

You don’t need perfection overnight. You need to patch high-risk gaps that could trigger fines or legal trouble. Here’s your focused, no-fluff action plan:

CCPA Compliance Steps

Let’s get into each step and understand exactly what to do.

Start with your privacy policy and collection notices—regulators look here first. If they’re outdated or vague, you're exposed.

Fix it now:

Then ensure it’s easy to find—on your homepage, checkout pages, and anywhere data is collected.

If users can’t opt out easily, you’re asking for trouble.

To fix:

Even if you’re not selling data, check your ad tech—behavioral targeting often qualifies.

You're legally required to respond to access, delete, and opt-out requests within strict timeframes.

Your quick-start setup:

You’re liable for your vendors’ mistakes. Prioritize reviewing those that handle customer data.

Steps:

Before deploying fancy tools, take a basic snapshot of your data flows.

Start with:

This quick map highlights your biggest risks fast.

This isn’t your forever strategy—it’s your emergency checklist. Patch the holes now. Then work on building systems that keep you compliant for the long haul.

Getting compliant is one thing. Staying compliant? That’s the real challenge.

Here’s what works for businesses that want to avoid compliance headaches down the line:

Employees are your biggest compliance risk. One-time training doesn’t cut it.

What you need:

Even unintentional mistakes can cost $7.50 per violation. Keep your team sharp.

Manual compliance = mistakes, missed deadlines, and burnout.

Smart businesses use tools for:

Automation helps you stay compliant while focusing on your actual business.

The more partners you share data with, the higher the risk. CPRA raised the bar for third-party compliance.

Ensure all vendor contracts include:

Remember: their failure becomes your liability.

CCPA mandates an annual privacy policy review. This isn’t optional.

Your yearly update should:

Privacy policies are living documents—treat them like it.

Compliance isn’t a checkbox. It’s a habit. But with the right systems, partners, and people in place, staying compliant doesn’t have to be overwhelming.

CCPA compliance isn't some optional nice-to-have. It's survival.

You've seen the numbers. You know the risks. You understand what's at stake. The question isn't whether you should get compliant—it's how fast you can make it happen.

Your roadmap is simple:

The regulatory landscape keeps shifting. CPRA already removed the safety net. Other states are following California's lead. Wait any longer, and you'll be playing catch-up forever.

But here's what most businesses miss: Compliance isn't just about avoiding fines.

It's about building something your customers actually want to buy from. A business that respects their privacy. A brand they can trust with their personal information.

Your competitors are still scrambling. Most are unprepared. Most are hoping they won't get caught.

You? You're going to be different.

Start with your privacy policy. Fix your consumer request system. Add that "Do Not Sell" link. Train your team. Review your vendor contracts.

Do it now. Do it right. Do it completely.

Because the companies that get this right won't just avoid fines—they'll earn something far more valuable.

Customer trust.

#nothingtohide

Take control of compliance, reduce risk, and build trust with UprootSecurity — where GRC becomes the bridge between checklists and real breach prevention. → Book a demo today

Senior Security Consultant