0%

Ever wonder why some companies breeze through audits while others barely survive? The answer isn’t luck. It’s audit findings.

These aren’t just bureaucratic checkboxes. They’re documented truths that expose what’s working—and what’s broken. Think of them as reality checks with teeth.

An audit finding is objective evidence collected during an audit that proves whether your process, product, or system actually does what it claims to do—no sugar-coating, no jargon. ISO 19011:2018 splits findings into conformity (you’re doing it right) and nonconformity (you’re not). Then there are observations—friendly nudges that highlight improvement opportunities before things go sideways.

Why care? Because audit findings reveal strengths, weaknesses, and hidden risks. In regulated industries, they’re survival tools. Smart companies don’t just fix what’s broken—they figure out why it broke, turn insights into action, and make audits a strategic advantage rather than a headache.

An audit finding is a snapshot of truth. It documents what auditors see—good, bad, or somewhere in between. It’s objective, concrete evidence that your processes, products, or systems either meet requirements or fall short.

ISO 19011:2018 guidelines divide findings into two main types: conformities (you’re doing it right) and nonconformities (you’re not). Observations, meanwhile, are early warnings—nudges that suggest improvements before problems become serious.

Why do audit findings matter? Because they’re more than compliance boxes. They reveal operational blind spots, hidden risks, and areas where your controls may fail. In regulated industries, they’re survival tools; in any business, they’re intelligence that drives improvement.

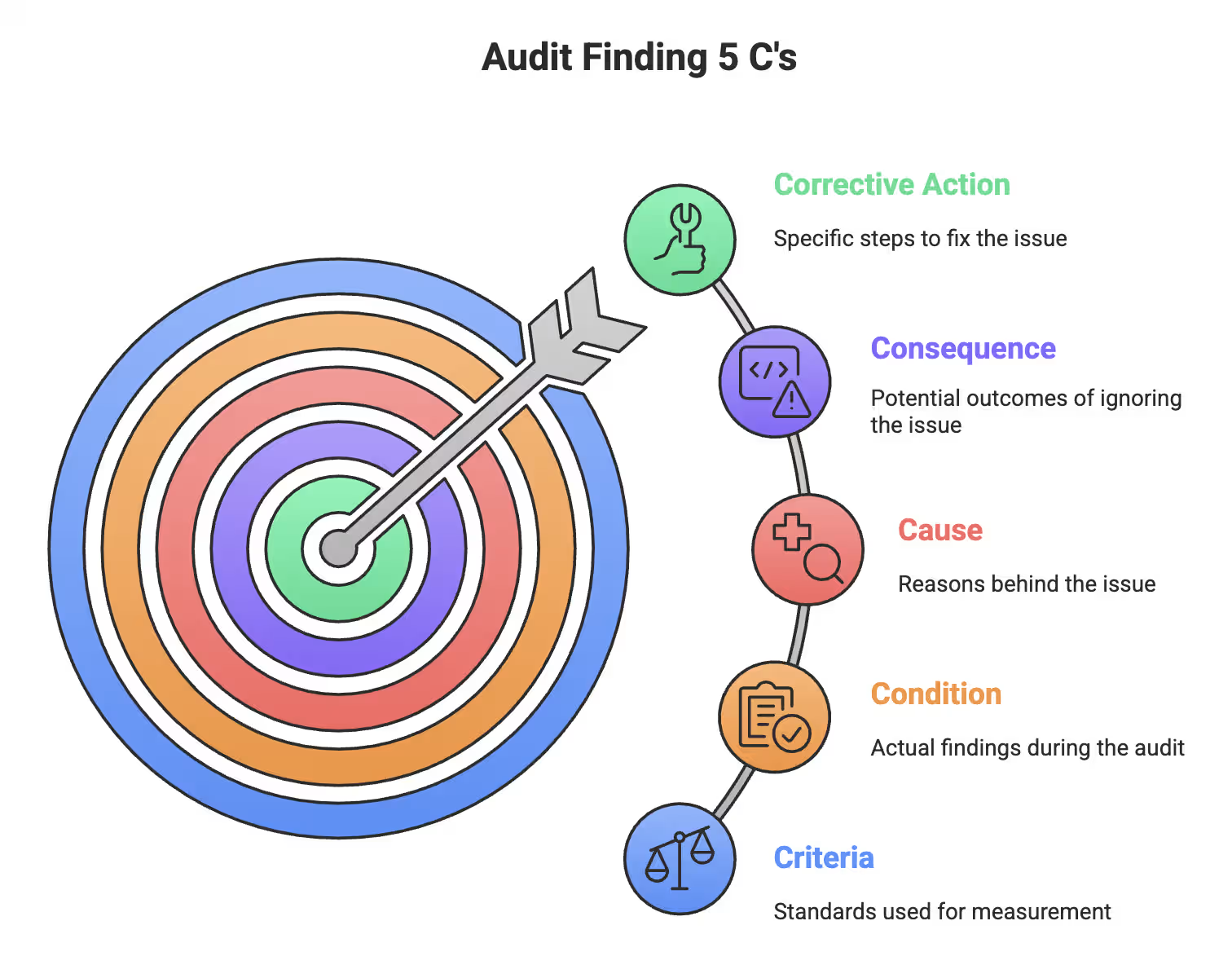

Good findings follow the 5 C’s framework: Criteria, Condition, Cause, Consequence, and Corrective action. Done right, they keep regulators happy, strengthen processes, and give your team a roadmap to fix problems before they become crises.

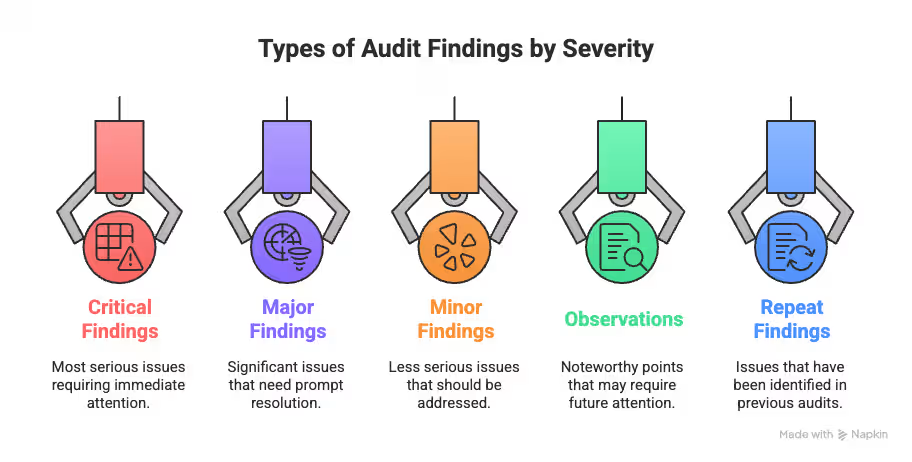

Not all audit findings are created equal. Some are minor speed bumps, others are five-alarm fires that can shut you down overnight. Smart organizations know the difference—and they prioritize accordingly.

These are the types of audit findings by severity:

Types of Audit Findings by Severity

Let’s break down what each one really means.

Critical findings are the audit equivalent of a medical emergency. They:

High-stakes issues that demand immediate action.

Major findings aren’t immediately life-threatening but serious enough to keep you awake at night. They:

Serious problems that need prompt corrective action.

Minor findings seem harmless—like paper cuts—but ignoring them can reveal bigger systemic problems. They:

Low-risk issues that can snowball if ignored.

Observations are audit findings’ gentler cousin. They:

Friendly nudges to prevent problems before they escalate.

Repeat findings are the audit world’s “we told you so.” They:

Recurring issues that signal systemic failure.

Addressing audit findings promptly isn’t just best practice—it’s survival. Each finding is an opportunity to uncover risks, tighten controls, improve processes, and prevent small issues from escalating. Treat them seriously, act decisively, and strengthen your organization.

Want to see what audit findings look like in the real world? Let’s pull back the curtain on how different industries get caught slipping.

Healthcare gets messy fast when privacy goes sideways. Picture this: a hospital employee leaves a detailed voicemail about a patient’s medical condition. Boom—HIPAA compliance violation for minimum necessary requirements.

The hits keep coming:

The numbers tell the story: as of November 2024, the Office for Civil Rights collected over $144 million from 152 HIPAA violation cases. Real money, real mistakes.

Manufacturing has its own pain points. Observations often target quality management systems that look good on paper but crumble under review.

Common culprits:

These aren’t violations—they’re early warning shots. Smart manufacturers fix workflow inefficiencies and strengthen preventive maintenance before minor hiccups turn into major headaches.

Financial services consistently stumble on internal controls. Key issues include:

Risk management is especially tricky around customer data protection and transaction monitoring. When money is involved, regulators don’t play.

Public sector audits reveal clear patterns. Florida’s 2022–23 fiscal year shows:

Top issues:

Every industry has patterns: healthcare loses control of private information, manufacturing neglects documentation, financial services mishandle risk, and government agencies fail to separate duties.

Smart organizations don’t just defend—they turn findings into improvement roadmaps, strengthening processes, controls, and compliance culture.

You know what separates amateur audit reports from professional ones? Structure. And brutal honesty.

Creating effective audit findings reports isn’t about fancy language or corporate speak. It’s about documenting the truth so clearly that even your CEO can’t ignore it. Here’s how to write reports that actually drive change.

Remember the 5 C's? Here’s how they work in practice:

Audit Finding 5 C's

Simple? Yes. Easy? Not so much.

ISO standards aren’t bureaucratic noise—they’re your roadmap:

Every finding must clearly state conformity or nonconformity. No wishy-washy middle ground. Talk through findings with the auditee before wrapping up—final-report surprises help nobody.

Your report needs four essential sections:

Keep it clean. Keep it clear. Keep it factual.

No evidence? No finding. It’s that simple.

Evidence forms the foundation of everything—findings, conclusions, recommendations. Quality matters: source, nature, and how you got it. Independent sources beat internal ones every time. Originals trump copies or electronic versions. Smart organizations use electronic quality management systems (eQMS) to track findings from discovery to closure, making everything faster, cleaner, and harder to lose.

A properly structured audit findings report doesn’t just document problems—it becomes the blueprint for fixing them.

Found some audit findings? Good. Now comes the part where most organizations mess up.

They slap a band-aid on the symptom and call it fixed. Then act surprised when the same issue pops up six months later. Here’s the deal: effective resolution isn’t about quick fixes—it’s about getting to the real problem.

Root cause analysis (RCA) separates smart companies from the ones that repeat mistakes. Skip surface-level fixes and dig deeper with proven methods:

Once you know what actually broke, build a Corrective and Preventive Action (CAPA) plan that tackles both the immediate issue and prevents future headaches. Make it specific: who does what, by when, and with what proof. Vague CAPAs are worthless CAPAs.

Deadlines aren’t suggestions—they’re requirements:

Assign findings to specific people, not entire departments. Departments don’t fix problems—people do.

Implemented your CAPA? Great. Now verify it works.

Trust but always verify.

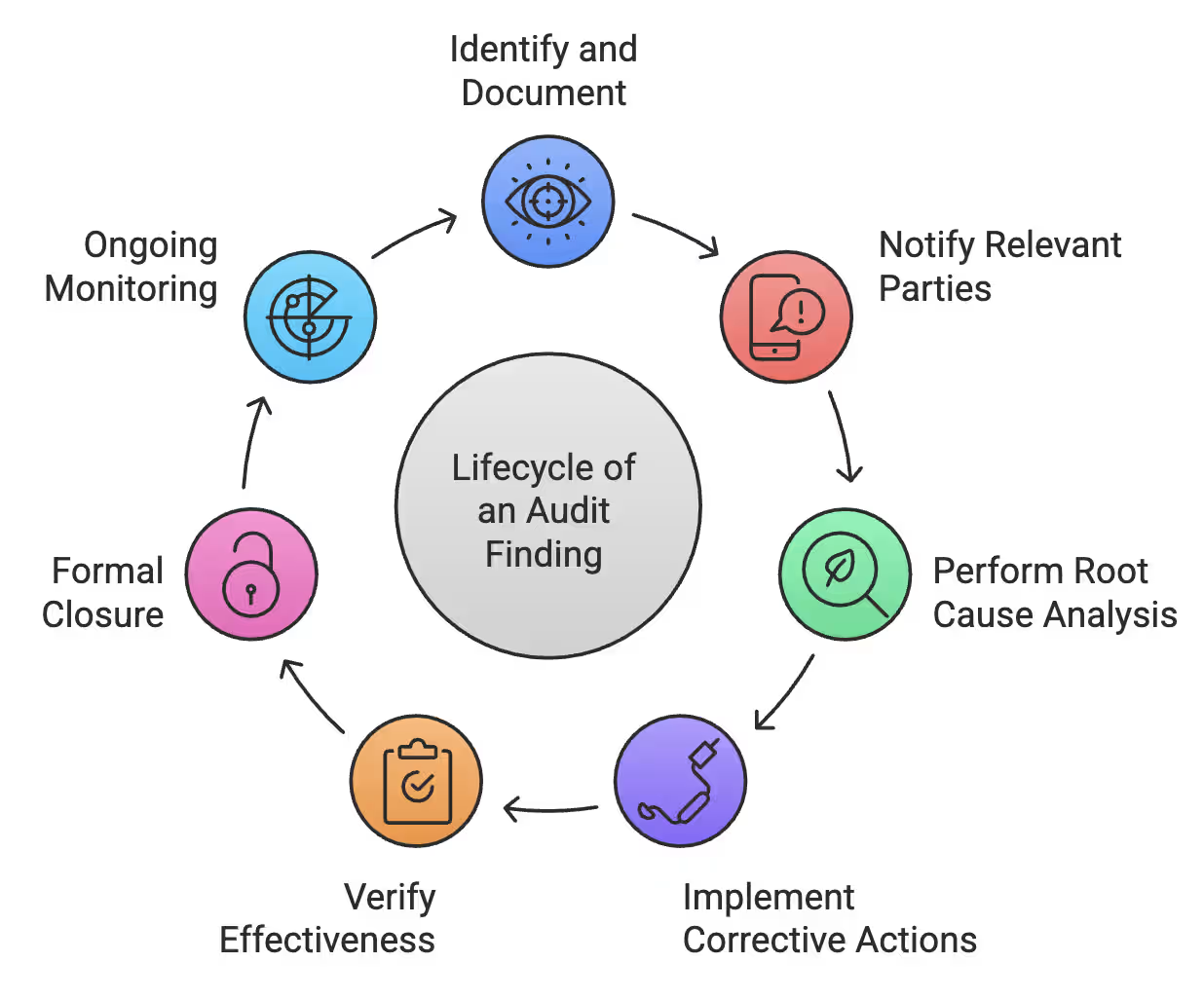

Every finding follows the same path:

Lifecycle of an Audit Finding

Document everything along the way. Not just to cover yourself—but because good documentation becomes your playbook for handling similar issues faster next time.

The companies that get this right turn audit findings into competitive advantages. The ones that don’t? They keep fighting the same battles year after year.

Which one are you?

Smart organizations don’t just survive audits—they use them to get ahead. Here’s how the winners do it.

Paper trails are dead. Electronic Quality Management Systems (eQMS) are where it’s at:

The best platforms track everything from planning to follow-up. Less stress, more efficiency—that’s the goal.

Your people make or break audit success. Train them to:

Well-trained teams turn audit findings into action, not just paperwork.

Repeat findings scream “systemic problem.” Stop them cold:

Continuous improvement stops repeat issues before they snowball.

Regulatory alignment isn’t optional—make it automatic:

Strong compliance frameworks keep your organization audit-ready and ahead of risks.

The companies that nail audit management don’t treat it like a chore—they treat it like a competitive advantage.

Audit findings aren’t going anywhere. Smart organizations have learned to turn them from compliance headaches into competitive weapons. The numbers speak for themselves: 64% of findings are “major,” HIPAA violations have cost $144M, and 6% of public entities carry material weaknesses. These are real risks—and real opportunities.

The 5 C’s framework isn’t just theory—it’s your roadmap to fixing problems for good, not slapping on band-aids. Winning companies jump on issues immediately, dig into the root cause, assign clear ownership, and follow up relentlessly.

Technology changes the game. eQMS platforms keep companies ahead, while manual processes lag behind. Audit findings reveal more than broken systems—they highlight hidden strengths and competitive advantages.

The winners don’t wait for inspectors. They stay audit-ready year-round, using findings as strategic tools to strengthen controls, improve processes, and drive real business excellence. That’s not just compliance—it’s smart business.

Turn audit findings into real security outcomes with UprootSecurity — where GRC moves beyond checklists to reduce risk, strengthen controls, and prevent breaches.

→ Book a demo today

Senior Security Consultant