0%

Ever notice how most businesses treat regulatory compliance like that awkward relative at family gatherings—the one everyone avoids until absolutely necessary?

The reality is, compliance isn’t just a legal checkbox or some bureaucratic burden your lawyers conjured. When done right, it’s a strategic advantage that separates industry leaders from followers.

The stakes are high. Ignoring privacy rules can cost millions in fines and lost opportunities. Compliance doesn’t sap resources—it safeguards them, keeping your revenue flowing and operations running smoothly. It also brings clarity and structure to everyday processes, reducing errors, streamlining decision-making, and giving teams the confidence to focus on growth rather than firefighting.

And then there’s trust. T-Mobile’s 2022 data breach exposed 77 million records and cost $350 million—decades of customer confidence vanished in a flash. Strong compliance acts as a shield for your relationships, ensuring clients, partners, and stakeholders know your business operates responsibly and reliably.

In short, compliance isn’t a burden. It’s a protective framework and a hidden lever for long-term resilience, efficiency, and credibility in today’s competitive market.

Most leaders see compliance as a necessary evil—a checklist exercise to keep regulators off their back. But the smart ones see something different: strategy. Every regulation you meet protects your cash flow, sharpens how you operate, and builds a moat around your reputation.

Start with money. Non-compliance isn’t cheap. GDPR fines can wipe out millions overnight, and that’s before you even factor in legal fees and settlements. Staying compliant isn’t about playing defense—it’s about keeping your money where it belongs: funding growth, not penalties.

Then there’s efficiency. Regulations like HIPAA or PCI DSS don’t just add rules, they force structure. Policies get documented. Processes become repeatable. Data gets handled consistently. The result? Fewer mistakes, smoother workflows, and teams that can actually focus on serving customers instead of scrambling to fix preventable errors.

And reputation? That’s priceless. A single data breach can take decades of trust and burn it in days. Compliance shows stakeholders you’re not cutting corners—you’re serious about protecting them.

At its core, regulatory compliance isn’t paperwork. It’s permission to compete, proof of trustworthiness, and in the right hands, a growth engine.

Different industries, different headaches. But here's what nobody tells you: understanding your specific regulatory maze is the difference between thriving and just surviving.

Healthcare folks deal with some seriously strict privacy rules:

Financial institutions get hit from multiple angles:

Digital commerce keeps evolving, and so do the rules:

Manufacturers, especially pharma companies, play by the strictest rulebook:

Each industry has its own compliance personality. Know yours, master it, and watch your competitors scramble to catch up.

Think compliance is optional? Let’s talk about what skipping regulatory compliance requirements for business really costs. Spoiler: it’s ugly.

Non-compliance hits your wallet first—and hard. GDPR fines can hit €20 million or 4% of global turnover, whichever hurts more. The average non-compliance fine in 2019? $145 million. Even “minor” slip-ups sting: BMW paid €10 million in South Korea for botched recalls.

And fines are just the start. Investigations drain resources, drag on for months, and distract your team from actually running the business. In worst cases, executives face personal liability—and yes, sometimes handcuffs.

Regulators don’t play. They can order you to stop business immediately. Licenses can be revoked, permits pulled, and accounts frozen. Even shipments get stuck at borders—like the Italian holiday cakes Canadian customs detained over a 0.7% alcohol issue. Talk about timing.

Without licenses, your doors shut overnight. No paperwork, no operations. The message is clear: no compliance, no business.

Money you can rebuild. Trust? That’s a different story. Customers walk away. Media outlets plaster your failures everywhere. Stock prices tank. Volkswagen’s emissions scandal cost billions in fines, but the reputational damage still lingers. Clothing brands linked to sweatshops faced the same brutal lesson.

The brutal truth: rebuilding credibility takes years of transparency and airtight corporate compliance regulations. Skip compliance now, and you’ll pay for it in cash, customers, and credibility.

Meeting regulatory compliance requirements for business is like playing a multi-level video game. The difference? The stakes are real money—and your business license.

It’s not just about dodging penalties. It’s about building a business that can scale, stay resilient, and actually work.

Your obligations come in three layers:

Ignore any of these, and you’re looking at penalties—or worse, administrative dissolution. Game over.

Business structure sets the rules. Corporations are high-maintenance: shareholder meetings, recorded minutes, bylaws, stock documentation. LLCs get it easier but still need operating agreements, membership records, and annual meetings. Regardless of structure, documenting decisions is non-negotiable. It’s insurance for your future self.

Every solid compliance plan includes four essentials:

Employees can’t follow rules they don’t know. Train staff regularly and document every session. Keep content role-specific so each team member understands exactly what applies to them.

Update training whenever regulations evolve, and track completion to ensure accountability. This not only ensures compliance but also reinforces customer trust and demonstrates your commitment to responsible business practices.

Compliance isn’t just paperwork—it’s the backbone of a resilient, scalable business. Skip it, and every other initiative becomes fragile.

Think of building a compliance plan like constructing a house—you can’t start with the roof. You need a solid foundation first. The good news? You don’t need a PhD in regulatory law to make this work. You just need structure and consistency.

Here are the five steps every business should follow:

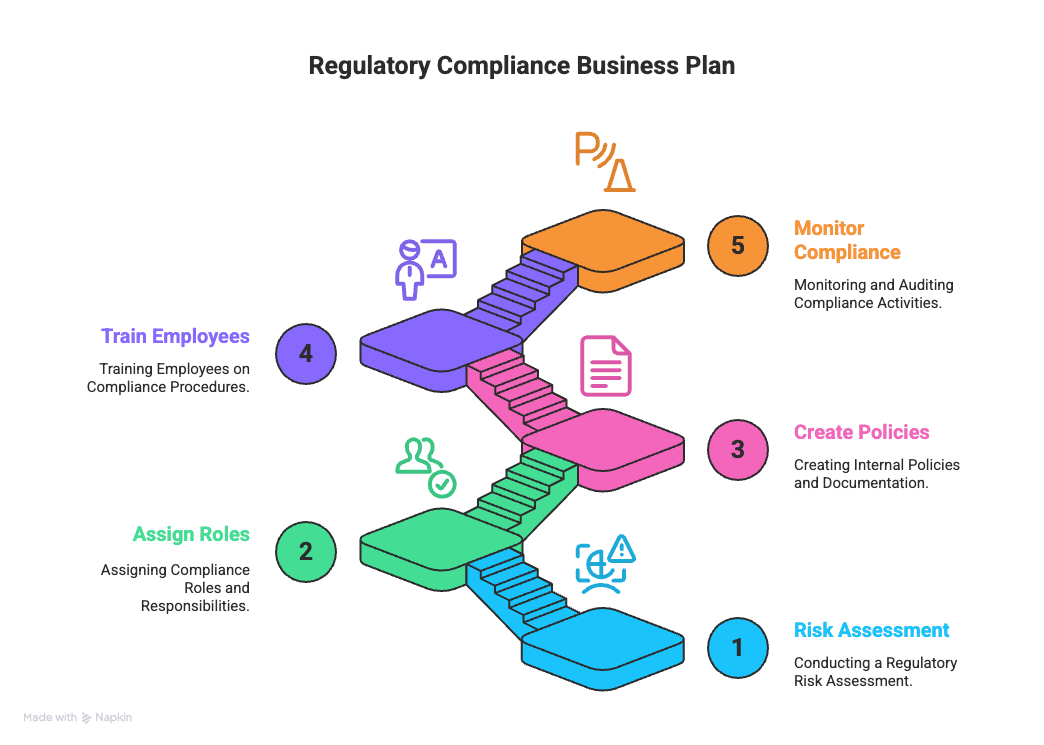

Regulatory Compliance Business Plan

Let’s get into each step in detail and see how they come together to form a plan that actually works.

Start here. Identify all regulations that apply to your industry and location. Break down their requirements into a checklist, then measure your current practices against those standards. The gaps you find will shape your compliance roadmap. Not glamorous, but essential.

Without ownership, compliance collapses. Appoint a compliance officer—internal or external depending on your size. Build a clear code of conduct and ensure leadership visibility. Everyone must know exactly who’s responsible for what.

Most businesses fail here. Policies should be short, clear, and specific. Standardize the format, cross-reference related rules, and define key terms. Document every procedure thoroughly so it stands up during audits. Think practical, not legal jargon.

Policies without training are useless. Deliver role-specific, ongoing training tied to regulatory updates. Document all sessions as proof. Use online or in-person formats, but keep it simple and actionable. Employees can’t follow what they don’t understand.

Trust but verify. Run regular audits to uncover weak spots and use continuous monitoring to catch risks early. Document results, track regulatory changes, and assign someone to stay current. Compliance isn’t “set it and forget it”—it’s maintenance.

Done right, this plan doesn’t just protect your business—it powers it.

Look, managing compliance manually is like trying to count grains of rice with tweezers. Possible? Sure. Smart? Not so much.

The good news? Technology actually makes compliance easier. Not harder. Easier.

Think of a CMS as your compliance command center. One place. Everything connected.

No more juggling seventeen different spreadsheets. No more "Did we file that report?" panic attacks at 3 AM.

Here's what manual evidence collection looks like: Months of digging through files. Endless email chains. Missing documents. Auditor nightmares.

Here's what automation looks like:

Your auditors will thank you. Your sanity will thank you more.

Remember playing that game where you whisper a message down a line of people? By the end, "I like pizza" becomes "Aliens invaded Nebraska."

That's compliance without real-time monitoring.

Smart systems give you:

No more guessing. No more surprises.

Regulations change constantly. Like, constantly. We're talking 50,000+ legislative updates every year. Good luck keeping track of that manually.

AI handles this chaos by:

Your compliance team can focus on strategy instead of playing regulatory whack-a-mole.

Smart businesses don't fight technology. They use it.

Managing compliance doesn’t have to feel like wrestling an octopus in a phone booth. The smartest companies crack the code by replacing chaos with structure. They don’t work harder—they work smarter. Here’s how.

Stop wasting hours hunting for spreadsheets buried in random folders. On average, organizations burn through 2,000 hours a year on compliance, with documentation eating 20–30% of that time. That’s an entire month of people just searching for files.

A centralized repository fixes that. Suddenly, your compliance status is visible in seconds. Cloud-based platforms let vendors submit directly, cutting the endless email tag. No more “I think Sarah has that file somewhere.” It’s all in one place, where it belongs.

Manual compliance is a productivity graveyard. Automation changes the game—slashing costs by 15–30%. Learning management systems track real-time compliance status. You’ll know who read the policy update, not just hope they did.

Policy management tools ensure updates don’t get buried in inboxes. Everyone’s aligned, everyone’s trained, and no one can claim they “missed the memo.”

Audits aren’t just boxes to tick—they’re your early warning system. More than half of audit executives outsource them because the technical lift is heavy. Don’t sweat bringing in help.

What matters is structure: clear scope, defined objectives, and airtight documentation. And follow-ups. Because promising to fix something is easy. Proving you fixed it is what counts.

Your compliance is only as strong as your weakest vendor. Risk management should cover the entire vendor lifecycle—not just the honeymoon phase.

Quarterly reviews with risk-based scorecards keep vendors accountable. Specialized software reduces the babysitting hours and flags red alerts early. That means fewer surprises and more focus on what actually grows your business.

Smart businesses weave compliance into daily operations, making it seamless rather than an afterthought.

Most companies see compliance as a burden. Smart ones see it as leverage. Done right, it’s not red tape—it’s your hidden advantage.

The numbers prove it. Businesses with strong compliance programs see 10–30% jumps in customer satisfaction and 20–40% cuts in administrative drag. Non-compliance costs 2.7 times more than doing it right the first time. In 2023, nearly 30% of organizations lost deals because they couldn’t prove compliance readiness.

The shift is clear. Companies that invest in compliance stand out in crowded markets. Clients choose them. Top talent joins them. They become the obvious partner because compliance signals credibility and trust.

They also move smarter. In mergers and acquisitions, mature compliance programs let stakeholders understand risks upfront. Security, ethics, and transparency are already baked into operations, giving them a competitive edge.

And then there’s reputation. Strong compliance becomes part of the brand story, featured in RFPs, pitches, and client conversations. It builds trust and generates intelligence that strengthens the business.

Your regulatory compliance business plan isn’t overhead. It’s your competitive advantage waiting to be unlocked.

Build trust and prevent breaches with UprootSecurity — making GRC the key to good security. → Book a demo today

Senior Security Consultant