Ever feel like compliance is a never-ending paper chase while your competitors glide past regulations? You’re not imagining it.

Financial institutions wrestle with a 9,000-page Dodd-Frank Act, plus Sarbanes-Oxley, Basel accords, and relentless anti-money-laundering rules. Add cross-border operations and it becomes regulatory whack-a-mole—each jurisdiction adding its own conflicting requirements.

The pressure is intense. Seventy-seven percent of executives say compliance complexity is throttling growth. And it’s only getting worse: the EU AI Act overlaps with more than 60 other legislative instruments. Manual processes? Like bringing a calculator to a supercomputer fight—slow, error-prone, impossible to scale.

Smart companies aren’t waiting to sink. They’re using AI in regulatory compliance to keep up with rules that change faster than teams can react. Forty-three percent of GRC professionals are already testing AI solutions. Another 35 percent are mapping strategies before rollout, and 14 percent have embedded AI directly into their compliance systems to stay ahead of tightening regulations.

The payoff is clear. In 2024, more than 60 percent of businesses improved compliance processes with AI, and 18 percent reported game-changing gains. In a world of exploding regulations, the old way of governance is dead. AI is fast becoming the only way to stay afloat—and stay ahead.

What Is AI Compliance, and Why Does AI for Compliance Matter in 2025?

AI compliance isn’t just about following rules—it’s about making sure your algorithms think and act responsibly. It means building, training, and deploying AI systems that meet legal, ethical, and regulatory standards across privacy, fairness, accountability, and security. In short, it’s how you keep your AI trustworthy.

But most compliance programs are stuck in the past. Endless spreadsheets, manual checks, and regional rule conflicts make it nearly impossible to keep up. That’s where AI steps in—not as another shiny tech promise, but as the engine that keeps compliance alive. It sifts through oceans of data in seconds, flags risks before they escalate, and adapts faster than human teams ever could. This new wave of regulatory AI gives organizations real-time visibility and control, bridging the gap between evolving rules and operational speed.

And it’s working. Nearly 38% of companies have slashed compliance time by over half, while another 37.6% now automate most of their audits and reporting. In high-stakes industries like healthcare and finance, AI-driven governance is no longer a luxury—it’s survival.

Even leadership structures are shifting. Legal, product, privacy, and engineering are finally speaking the same language. And at the top, new roles like Chief AI Officer are emerging to steer the ship.

AI for compliance in 2025 isn’t optional—it’s a competitive advantage.

Understanding AI for Regulatory Compliance

Regulatory landscapes are getting messier every day. AI compliance isn’t just another buzzword—it’s becoming the difference between companies that survive regulatory chaos and those that don’t. But what does it really mean, and why is it changing everything?

AI Based Compliance: The Simple Truth

AI-based compliance uses artificial intelligence to make sure you follow laws, regulations, and internal policies—without drowning in paperwork or missing critical risks. Under the hood, it combines:

- Machine learning: Spots unusual patterns and predicts violations before they happen.

- Natural language processing (NLP): Reads complex regulatory documents so you don’t have to.

- Robotic process automation (RPA): Handles repetitive compliance tasks automatically, freeing your team to focus on decisions that matter.

The magic? These systems don’t just flag problems—they catch issues before they snowball into full-blown regulatory disasters, saving time, money, and reputational damage.

How AI Compliance Differs from Traditional Methods

Traditional compliance is like a security guard with a clipboard. Regulatory compliance AI is a team of detectives with superpowers. JPMorgan’s AI system, for example, cut document review from 360,000 hours to mere seconds. Machine learning boosts detection rates from 30% to over 50% compared to rigid rule-based systems, and banks report 35–55% cost reductions after replacing legacy software with AI platforms.

Industries Most Impacted by AI Compliance

AI for regulatory compliance is reshaping industries fast. Financial services lead the charge, catching fraud, money laundering, and credit card theft while reducing false positives. Healthcare uses AI to process FDA documents and stay audit-ready. Retail and e-commerce balance personalization with GDPR and CCPA compliance. Manufacturing monitors production to catch deviations from Good Manufacturing Practices before auditors arrive.

The companies moving quickly aren’t just staying compliant—they’re building competitive advantages. Their slower competitors? Still stuck in outdated, manual processes, struggling to keep up with the fast-moving regulatory tide and rising customer expectations across every sector.

Key Global Frameworks for AI in Compliance

Different countries are playing different games with AI compliance. If you don’t know the rules, you’re going to get burned. Here’s how today’s top AI compliance frameworks stack up:

EU AI Act: The Heavy Hitter

Europe isn’t messing around. The EU AI Act uses a four-tier risk system:

- Unacceptable risk: Banned—think government social scoring.

- High risk: Healthcare and critical applications need serious documentation.

- Limited risk: You must disclose AI use (yes, chatbots too).

- Minimal risk: Most AI gets a free pass.

The cost of getting it wrong? Up to €35 million or 7% of global revenue. Full compliance is mandatory by 2026, so the clock is ticking.

NIST AI RMF: America’s Guideline Approach

The US took a softer, voluntary route. NIST focuses on four pillars:

- Govern: Set policies that make teams think about AI risk.

- Map: Identify what could go wrong with AI systems.

- Measure: Continuously test AI to ensure it isn’t going rogue.

- Manage: Enforce risk management through accountability and action.

No fines yet—just strong guidance to keep AI safe and responsible.

ISO 42001: The Credibility Badge

Released in December 2023, ISO 42001 is the first international standard for AI management systems. Using Plan-Do-Check-Act methodology, it helps companies:

- Set up functional governance policies

- Identify risks proactively

- Monitor AI performance continuously

This standard is quickly becoming the gold mark of credibility. Smart organizations adopt it before mandatory compliance pushes them to.

The Rest of the World

Forty-seven countries follow OECD AI Principles, updated for generative AI and evolving systems. China focuses on algorithm transparency and content control, with real penalties for non-compliance.

The bottom line: overlapping global rules aren’t always compatible. Pick frameworks based on where you operate, but don’t assume one-size-fits-all. Knowing the rules—and staying ahead—is your best chance to avoid costly mistakes.

Real-World Consequences of AI Non-Compliance

AI compliance failures in 2025 don’t end with a warning—they end with consequences that hit every corner of a business. Regulators are issuing record fines, deleting AI models, and holding executives personally accountable. Non-compliance now threatens not just profits, but long-term survival.

1. Financial Penalties That Hurt

Regulators mean business. The EU AI Act imposes fines up to €35 million or 7% of global revenue, while the FTC has ordered companies to delete entire AI models trained on non-compliant data. Even minor lapses—like poor documentation—can lead to multimillion-dollar penalties. Rebuilding compliant systems afterward often costs more than the fine itself.

2. Reputational Damage That Lingers

Once trust is lost, everything else follows. Non-compliance erodes confidence among customers, investors, and partners. Headlines about “unethical AI” can tank valuations and push clients toward competitors seen as safer. Rebuilding credibility takes years—and some brands never recover.

3. Operational Disruption That Stalls Growth

Investigations and audits drain focus and resources. Teams scramble to gather evidence, patch gaps, and halt new launches until compliance is restored. In regulated industries, the fallout is worse—licence suspensions or product recalls can bring operations to a stop.

4. Executive Liability That Raises the Stakes

Regulators are targeting leadership directly. Executives face personal fines, disqualification, or even criminal investigation for negligence in AI governance. Boards are under growing pressure to prove oversight with real documentation—not just policies on paper.

Non-compliance doesn’t just cost money—it costs trust, reputation, and leadership credibility. In the era of AI accountability, staying compliant isn’t optional—it’s the only way to stay in business.

How Regulatory Compliance AI Works in Practice

Forget the frameworks—here’s what happens when AI actually takes over compliance. These systems never sleep, sift through massive datasets, and catch risks before humans even notice. Compliance becomes faster, smarter, and far less painful, turning what was once a reactive chore into a proactive advantage.

Your System Never Sleeps

Modern compliance AI processes over a terabyte of financial data per hour, with query responses under three seconds. Traditional batch analysis is history. Time-to-detection for fraudulent activity drops from nearly a full day to just a few minutes. Companies using these systems report 64% fewer fraud losses, 72% fewer false positives, and insights arriving 83% faster. Continuous monitoring ensures that no anomaly goes unnoticed, keeping organizations one step ahead of regulators.

Document Review Without the Headache

Weeks of slogging through contracts and regulatory documents are gone. AI now handles even the most complex legal files, extracting key terms and metadata, scoring compliance alignment, and generating audit-ready trails. Every action is logged, creating a tamper-proof record that satisfies both internal and external auditors while freeing legal teams to focus on strategic priorities.

Risk Scoring That Actually Works

Machine learning connects the dots humans often miss, analyzing both historical and real-time data to flag potential compliance risks before they escalate. Platforms like Swimlane come pre-mapped to 30+ global standards, assign role-based ownership, and produce audit-ready reports automatically, making risk management far more precise and actionable.

Evidence Collection on Autopilot

Platforms like Vanta run thousands of automated tests every hour across hundreds of integrations, continuously monitoring compliance posture. Organizations spend 82% less time per framework, complete audits in half the usual time, and never scramble to collect evidence because it’s already captured and organized.

From “check once in a while” to “monitor everything, always,” AI is transforming compliance into a proactive, data-driven advantage that keeps companies ahead of risk and regulators alike.

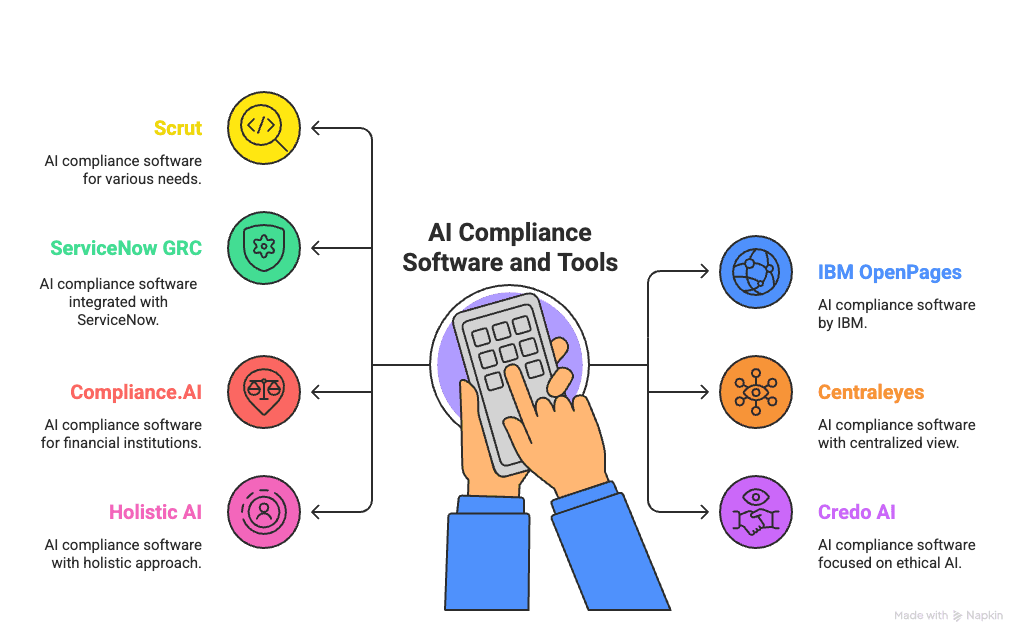

AI Compliance Software and Tools to Watch

The AI compliance software game is messy. Lots of vendors make big promises—but only a few actually deliver. Here are the tools to watch:

- Scrut

- IBM OpenPages

- ServiceNow GRC

- Centraleyes

- Compliance.ai

- Credo AI

- Holistic AI

AI Compliance Software and Tools

Let’s see what makes each one worth your attention.

1. Scrut

Scrut figured out something smart—growing companies don’t need enterprise complexity. Their "Scrut Teammates" AI agents handle compliance work without extra hires. Cuts manual work by 80%, monitors infrastructure 24/7, and comes with pre-built frameworks so you can start immediately.

2. IBM OpenPages

Big companies with big compliance headaches need big solutions. IBM OpenPages offers a GRC virtual assistant that works around the clock, and watsonx integration kicks in automatically with triggered workflows. Enterprise-grade compliance without the usual headaches.

3. ServiceNow GRC

ServiceNow manages AI systems from creation to retirement while keeping them compliant. Its impact assessments flag high-risk AI early, while automated workflows streamline governance, making it easier for organizations to scale AI safely without sacrificing regulatory adherence.

4. Centraleyes

Centraleyes keeps you ahead of shifting regulations. It alerts teams when rules change, explains how they affect your business, and automatically links risks to existing controls—helping organizations stay compliant and proactive without constant manual oversight.

5. Compliance AI

Compliance.AI leverages machine learning to monitor regulatory changes and deliver personalized dashboards. It maps obligations to your policies automatically, eliminating manual tracking, saving time, and ensuring your teams always have up-to-date guidance for effective compliance management.

6. Credo AI

Credo AI focuses on AI model governance. Continuous monitoring tracks model performance, flags compliance gaps, and aligns with global standards. Recognized as a Forrester Leader, it helps teams implement AI governance faster while cutting manual work and keeping systems audit-ready.

7. Holistic AI

Holistic AI comes pre-configured for global regulations like the EU AI Act and ISO 42001. Continuous monitoring tracks model performance and alerts teams if metrics drift outside acceptable ranges, keeping AI audit-ready with minimal effort.

The bottom line: Pick the tool that matches your company size, regulatory needs, and AI ambitions. The right platform turns compliance from a headache into a competitive advantage.

Challenges in AI and Compliance You Can’t Ignore

Look, AI compliance isn’t all sunshine and automation. Smart companies know there are real problems hiding beneath the shiny success stories. Pretending these challenges don’t exist? That’s how you end up with compliance failures making headlines.

Explainability and Transparency

The “black box” problem is still wreaking havoc. Only 32% of organizations can explain how AI makes compliance decisions. Seventy-eight percent of regulated industries struggle to document AI decision trails for auditors. Financial institutions spend over three times more time explaining AI decisions than creating them. When auditors come knocking, “the AI said so” won’t cut it.

Bias Detection and Mitigation

Algorithmic bias is real, and many teams aren’t prepared. Sixty-three percent lack tools to detect bias, and hidden biases appear in 41% of third-party AI solutions after deployment. That “unbiased” AI system? It might be more biased than your old manual processes.

Cross-Border Conflicts

Global AI compliance is messy. Fifty-eight percent of enterprises face contradictory requirements across countries. Managing cross-border data flows costs nearly three times more than domestic operations. What’s legal in London might be banned in Beijing, and keeping track is exhausting.

Shadow AI and Oversight Gaps

The most dangerous challenge? AI tools your teams use without telling you. Seventy-three percent of organizations discovered unauthorized AI in compliance functions. Forty-seven percent can’t track all AI applications in use, and only 22% have formal approval procedures. Your employees are already using AI—do you know what they’re using?

The companies winning at AI compliance aren’t avoiding these challenges—they tackle them directly. Ignoring the issues only makes them costlier later.

Best Practices for a Successful Compliance AI Program

You’ve seen the tools. You know the challenges. Now here’s how to make AI compliance actually work—without it blowing up in your face. Spoiler: it’s not just buying software and hoping for the best. Companies that get it right focus on four fundamentals.

Establish Internal AI Governance Frameworks

Smart organizations set the rules upfront. They define acceptable AI use cases, create guardrails to block harmful content, follow ISO 42001’s Plan-Do-Check-Act methodology, and run privacy impact assessments to protect sensitive data. Structured governance ensures AI decisions align with regulations and internal policies from day one.

Assign Cross-Functional Ownership

Dumping AI compliance on IT and walking away doesn’t work. The best companies form cross-functional committees with legal, risk, IT, and engineering involved. Centralized governance doubles the chance of scaling AI responsibly. RACI matrices clarify responsibilities, and high-risk AI applications always have accountable owners.

Maintain Documentation and Audit Readiness

Auditors don’t wait. Standardize how AI project info—model name, version, purpose—is recorded. Automated evidence collection can cut audit time by 82%. Store everything in accessible repositories and maintain detailed, timestamped audit trails for every AI interaction.

Continuous Model Monitoring and Retraining

AI isn’t “set it and forget it.” Models drift as environments change. Regular retraining on fresh data keeps systems compliant. Automated monitoring flags performance drops, and algorithms like Page-Hinkley or Adaptive Windowing catch deviations before they turn into compliance nightmares.

Companies that nail these four practices don’t just survive regulatory scrutiny—they turn AI compliance into a strategic advantage, reducing risk, saving time, and staying ahead of regulators and competitors alike.

Building Trust Through AI Compliance

Trust. Everyone talks about it, but few actually build it. The gap is staggering: 73% of C-suite executives say ethical AI guidelines matter, yet only 6% have developed them. The Department of Justice highlighted the same disconnect, asking: Are your systems well-designed? Are they actually implemented? And most importantly—do they work in practice?

Real trust isn’t built with fancy presentations or boardroom promises. It comes from crystal-clear documentation that anyone can understand, continuous improvement that actually happens, and cross-functional teams—legal, tech, and compliance—working together instead of pointing fingers.

Companies doing it right aren’t hiding complexity. Novartis, for example, built an AI Risk and Compliance Management framework aligned with the EU AI Act while protecting patient data and ensuring operational transparency.

The truth about compliance AI? It’s not just about avoiding penalties. When documentation, oversight, and iterative improvement are done well, you don’t just satisfy regulators—you reduce real risks, enhance decision-making, and build genuine stakeholder confidence.

Compliance becomes a competitive advantage, and trust? That’s far more valuable than any certificate or checkbox.

Take control of compliance, reduce risk, and build trust with UprootSecurity — where GRC becomes the bridge between checklists and real breach prevention.

→ Book a demo today

Frequently Asked Questions

Robin Joseph

Senior Security Consultant