0%

Ever wondered who really decides whether a company’s numbers can be trusted?

Meet the Big 4 auditors. Four firms whose influence reaches far beyond spreadsheets and balance sheets. They don’t just review financial statements—they define what “fair and accurate” means in global business.

These aren’t traditional accounting firms. They are institutional gatekeepers. When they approve a set of books, markets move and investors gain confidence. When they hesitate, deals stall, valuations wobble, and scrutiny intensifies. Their opinions shape how risk is perceived and how capital flows.

From public listings to cross-border investments, the Big 4 sit quietly behind the scenes, validating the information that powers modern finance. Their presence is often invisible, but their impact is not. Entire industries depend on their sign-off to operate at scale.

Understanding who they are—and how their influence works—is essential for anyone navigating audits, compliance, or financial decision-making in today’s interconnected economy.

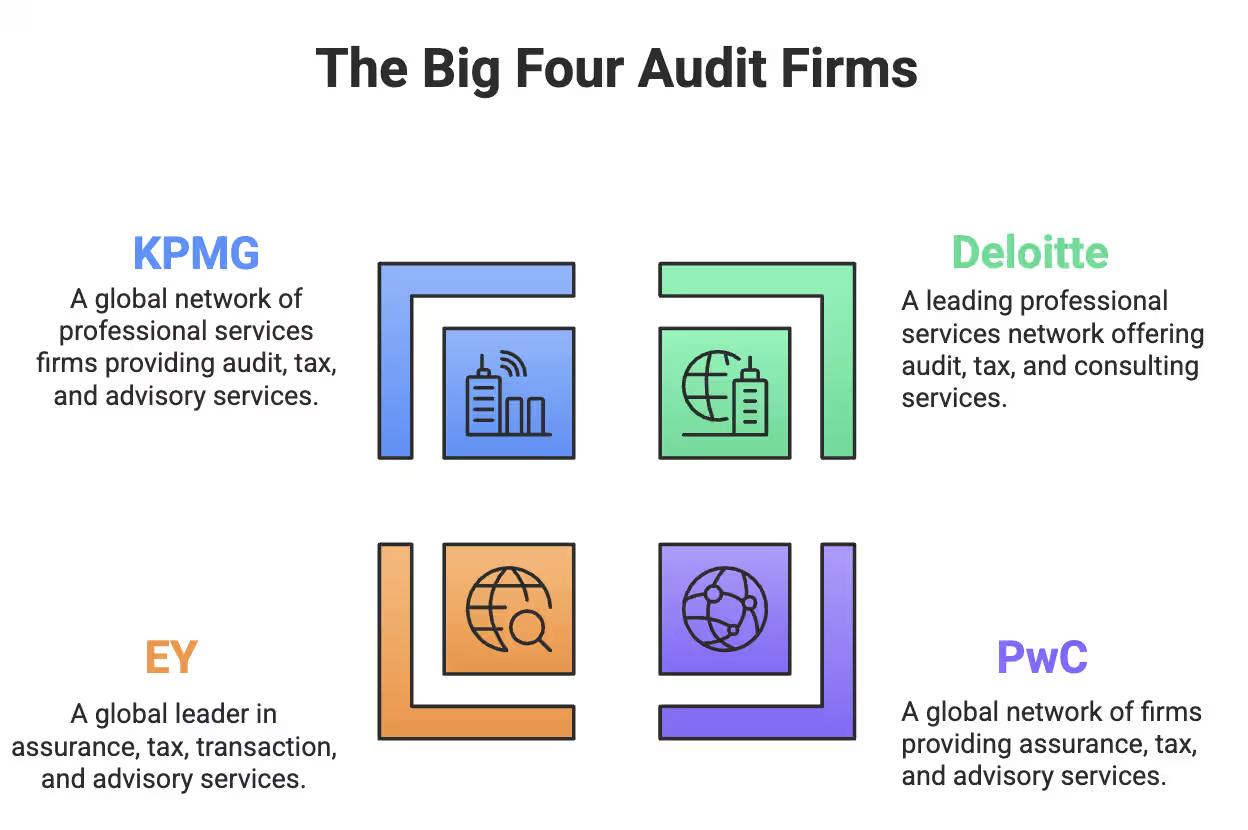

Deloitte, PwC, EY, and KPMG dominate the global audit landscape. These four firms sit at the center of financial reporting, acting as the primary gatekeepers of trust between companies, investors, and regulators worldwide.

They matter because modern markets run on confidence. Every Fortune 500 company is audited by one of the Big 4 auditors, along with most large public companies globally. When a Big 4 firm approves financial statements, investors rely on that opinion to make decisions involving billions of dollars.

Their importance goes beyond size. The Big 4 creates consistency in how financial data is reviewed, especially for multinational organizations operating across different regulatory systems. This standardization reduces uncertainty and makes cross-border investment possible at scale.

Auditing is no longer their only role. These firms also influence governance, risk management, cybersecurity, and compliance through advisory services that shape how organizations operate internally.

In regions with weaker regulatory oversight, a Big 4 audit often serves as a substitute for strong investor protections. By reinforcing credibility and reducing perceived risk, the Big 4 auditors help companies access capital and sustain global economic activity.

Behind polished branding and global reach, each Big Four firm operates with a distinct mindset. In 2026, all four are adapting to the same forces—AI-led audits, rising scrutiny, and client expectations for speed without sacrificing trust. What separates them is how they execute.

The Big Four Audit Firms

Deloitte

Deloitte leads with scale and ambition, turning its size into a strategic advantage rather than a constraint. Its global footprint allows it to tackle massive, complex audits while investing heavily in innovation. The firm emphasizes technology-driven solutions, ensuring teams can focus on high-value judgment rather than repetitive tasks.

Deloitte’s ecosystem-driven model lets it coordinate cross-disciplinary teams at scale, solving problems without creating central bottlenecks and maintaining agility across markets.

PWC

PwC is built on consistency, discipline, and repeatable execution, making it one of the most trusted audit firms globally. The firm invests heavily in technology while cultivating talent through structured career paths, creating a predictable yet innovative audit experience.

PwC’s focus on standardization and technological adoption allows it to deliver large-scale audit transformation reliably, making complex global engagements manageable and repeatable.

EY

EY positions itself as a people-first, long-term value-driven firm. Its strategy integrates digital, data, and analytics into client work while prioritizing talent development internally. EY emphasizes mentoring, flexible policies, and strategic consulting, aiming to help clients reinvent their business models sustainably.

EY’s approach balances people and technology, believing that successful transformation starts with developing and empowering the workforce.

KPMG

KPMG takes a deliberate, research-driven approach, focusing on sustainable growth rather than rapid expansion. Its expertise lies in translating AI experiments into operational results while providing employees with early responsibility and a balanced work environment.

KPMG emphasizes depth and stability, applying rigorous research and technology adoption to support long-term client value while maintaining a practical approach to global operations.

Despite different styles, all four firms share one reality in 2026: success now depends on how well technology, talent, and judgment work together to sustain trust at scale.

The Big Four don’t operate in silos anymore.

Each service line feeds the next, creating an ecosystem where financial insight turns into strategic control across industries.

This is still their foundation—but it’s no longer routine checking or box-ticking.

Modern audits now shape credibility, investor confidence, and regulatory trust worldwide.

When markets ask, “Can this company be trusted?” audit answers first.

Tax is where complexity explodes—and where the Big Four quietly dominate outcomes.

Global rules shift constantly, and mistakes here cost billions.

They track reforms early, helping companies adapt before enforcement even begins.

This is where insight turns into influence—and revenue scales fastest.

Audit visibility gives these firms unmatched clarity into what’s broken.

They don’t just diagnose problems—they design the solution.

Risk is no longer hypothetical or technical—it’s financial and reputational.

Executives now demand measurable answers, not abstract warnings.

Their edge is translating uncertainty into board-level decisions.

When failures turn public, precision matters more than speed.

This is where the Big Four become corporate first responders.

These teams stabilize organizations when scrutiny peaks.

The Big Four no longer sit outside business operations.

They’re embedded inside them—defining standards, shaping decisions, and sustaining global trust.

Breaking into the Big Four isn’t about luck—it’s about preparation.

Every year, thousands get in because they follow a clear, repeatable path. Once inside, the learning curve is steep, fast, and career-defining.

Education is your entry ticket—but credentials decide how fast doors open.

Big Four firms look for proof that you can handle complexity and pressure.

Most firms actively support certification with bonuses and exam incentives.

Internships remain the fastest way in.

They double as extended interviews and skill accelerators.

Many full-time offers are decided before graduation.

Technical knowledge alone won’t get you hired.

Recruiters evaluate how you think, communicate, and adapt.

Global awareness, tech comfort, and people skills strengthen your profile.

Interviews test readiness, not perfection.

Preparation separates serious candidates from hopeful ones.

Small gestures, like personalized follow-ups, still make a difference.

Life inside the Big Four is demanding—but intentionally so.

The payoff comes through accelerated exposure and credibility.

The pressure is real, but the exposure, credibility, and long-term career leverage make the trade-off worthwhile.

You don’t have to go with the Big Four.

Despite their global dominance, mid-tier firms have quietly built credibility, offering real alternatives for organizations that want attention, flexibility, and value instead of brand-driven processes. For many companies and professionals, these firms aren’t compromises—they’re strategic choices.

RSM and Grant Thornton are the first names that come up outside the Big Four.

They combine international reach with a more human, relationship-driven approach, giving clients access to senior teams and personalized attention.

Grant Thornton differentiates itself through full-population testing instead of samples and continued investment in financial services and technology.

BDO and Crowe offer global scale without the bureaucracy of the Big Four.

They balance international standards with localized expertise, delivering solutions tailored to client needs.

Crowe’s member-firm structure enables local insight while maintaining global consistency.

These firms focus where broader audit firms often generalize.

They specialize in risk, internal audit, and technology-driven assurance, appealing to organizations that need precision and innovation.

Protiviti and Satori Assured stand out by combining deep specialization with technology-driven approaches.

The shift toward mid-tier firms is deliberate.

Companies and professionals see tangible advantages in responsiveness, career opportunities, and service quality.

Mid-tier firms succeed by delivering attention, flexibility, and outcomes that align with client priorities.

The Big Four aren’t going anywhere. Deloitte, PwC, EY, and KPMG have built a system that audits every Fortune 500 company and anchors trust across global financial markets. Their dominance comes from scale, brand power, and decades of institutional presence.

They are not without flaws. Audit failures, conflicts between consulting revenue and independence, and sustained regulatory criticism continue to raise questions about accountability and oversight in the profession.

Yet dependence on the Big Four remains strong. For professionals, the workload is intense, but the exposure compresses years of learning and accelerates long-term career growth. For organizations, mid-tier firms offer capable alternatives, yet markets still see them as riskier choices.

That perception keeps the system intact. Even as AI, regulation, and reform reshape auditing, the Big Four remain deeply embedded in global finance. In 2026, they function less as service providers and more as the infrastructure supporting trust in modern markets worldwide. For now, their role remains unavoidable for global capital.

Senior Security Consultant