0%

Ever wonder who keeps companies honest when regulators come knocking? That’s the job of compliance auditors. Working quietly behind the scenes, they ensure businesses don’t cut corners on rules, regulations, and internal controls that protect customers, data, and reputations.

In today’s world, one mistake can trigger lawsuits, fines, or public backlash. Compliance auditors help organizations avoid these risks, ensuring what companies say they do matches what actually happens.

From healthcare and finance to IT and manufacturing, they operate wherever rules exist. They test processes, review records, interview employees, and verify policies are followed in practice — not just written in manuals that gather dust.

Their mission is simple but crucial: spot gaps before regulators do. Because when compliance fails, the consequences aren’t just theoretical — they’re costly, public, and often irreversible.

A compliance auditor evaluates whether an organization truly follows the rules it claims to. They review not only external laws and regulations but also internal policies, procedures, and practices designed to keep the organization ethical, secure, and legally safe.

Unlike internal staff who may be too close to daily operations, compliance auditors are independent and objective. Their role is to spot risks before they become violations and highlight weaknesses before they make headlines.

They conduct internal and external audits, analyze records, review processes, and interview staff to see how work is actually done. They stay on top of changing regulations and help organizations adapt to new legal requirements.

Beyond identifying issues, compliance auditors recommend improvements, train employees, and provide leadership with clear, actionable insights. Simply put, they are the professionals who keep organizations accountable, prepared, and protected.

Compliance auditors don’t just tick boxes. They stand between your business and regulatory disasters, spotting issues before they explode into fines, lawsuits, or reputation damage.

This isn’t a boring desk job. It’s high-stakes risk control, where one missed detail can cost millions.

Compliance auditors run two different types of evaluations:

Internal Audits – Handled by employees who report directly to the audit committee. These happen year-round, tightening controls, improving processes, and stopping small risks from exploding into major failures.

External Audits – Run by independent professionals brought in to verify regulatory compliance. They cost more, but they exist for regulators, investors, and stakeholders who need proof — not promises.

Both follow a strict structure: planning, fieldwork, and reporting. No shortcuts.

When reviewing your policies, compliance auditors go into detective mode:

They don’t chase crimes. They stop them before they happen.

After the deep dive, auditors produce reports that include:

Here’s the difference between average and great auditors: objectivity. They don’t dictate. They collaborate. They help leadership agree on fixes that work in the real world.

Compliance auditors constantly track new rules because:

Regulations don’t sleep. Neither do serious compliance teams.

Smart auditors don’t just find problems — they block them early by:

This job demands critical thinking, attention to detail, and independent judgment. Companies now see the truth: proactive compliance is cheaper than reactive damage control.

Bottom line? They’re not rule-followers. They’re rule-protectors.

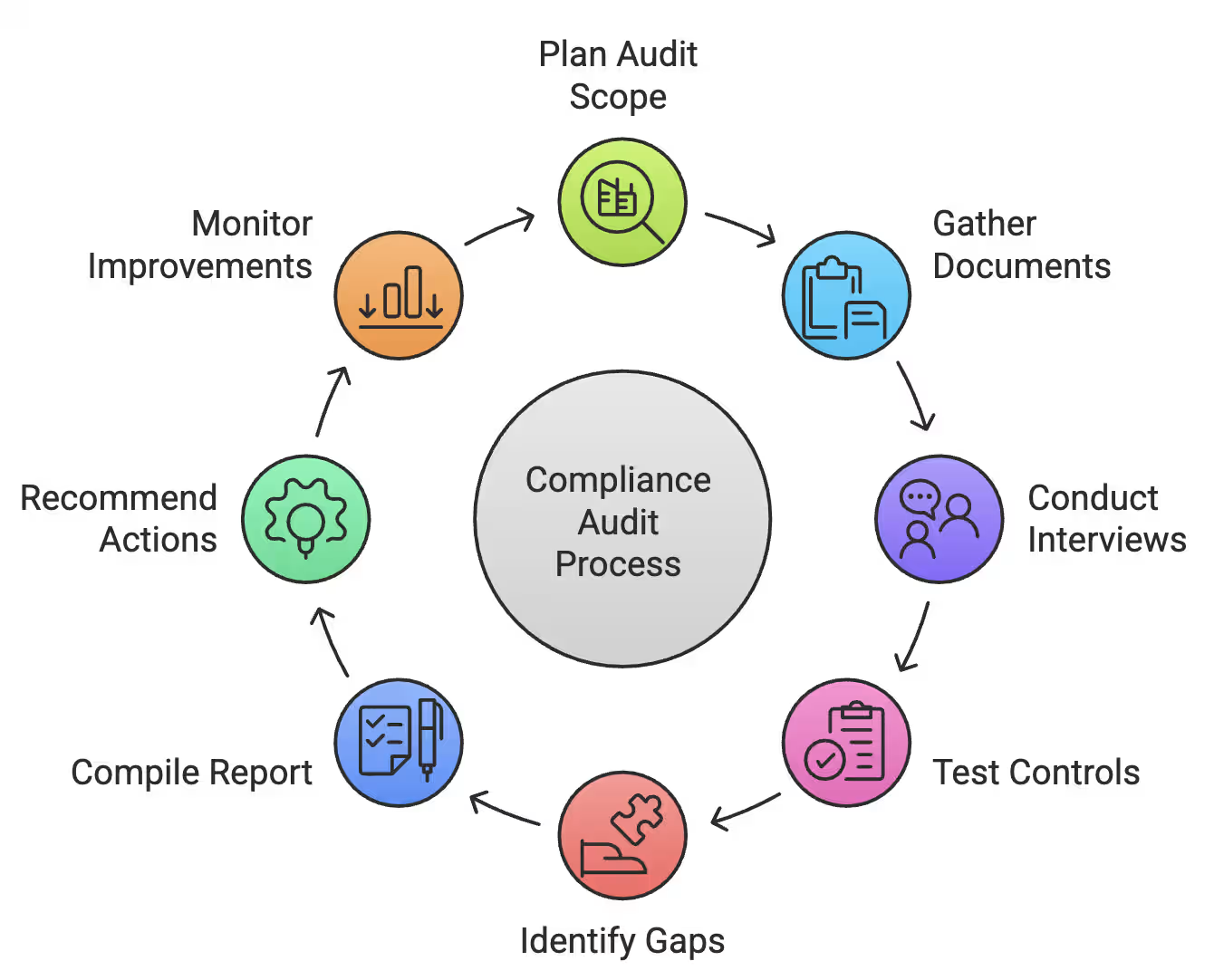

Think audits just happen randomly? Nope. Smart organizations follow a clear, repeatable system to stay ahead of regulators, reduce risk, and avoid nasty surprises. A structured audit process makes the difference between scrambling during inspections and staying in control.

These are the steps in the audit and compliance process:

Here’s how each step works in practice:

Good audits begin with careful planning. Teams assess potential risks, define boundaries, and set objectives focused on high-risk areas. Key steps include:

A well-planned audit ensures nothing is overlooked and sets the stage for efficient, effective evaluations.

Evidence forms the backbone of any audit. Auditors gather physical proof, records, and staff testimonials to confirm what is actually happening. Key actions:

Organized evidence allows auditors to draw accurate conclusions and supports informed decision-making.

Documents show what should happen, but interviews reveal reality. Steps include:

Direct engagement uncovers practical gaps and strengthens audit credibility.

Auditors verify whether internal controls are actually working as designed. This step focuses only on control performance, not risk analysis:

This step confirms whether controls exist and function correctly in daily operations.

Once controls are tested, auditors move into risk identification. This step is about analyzing results and spotting weaknesses:

This step transforms test results into clear, actionable risk insights.

The report presents scope, methodology, evidence, findings, and prioritized recommendations:

A clear, well-structured report turns findings into action and keeps teams aligned on what to fix next.

Findings mean nothing without fixes. After identifying gaps, auditors lay out clear, practical steps to close them:

Strong recommendations turn audit findings into real, measurable improvements.

Fixing issues once isn’t enough — they have to stay fixed. This step keeps the organization on track:

Ongoing monitoring ensures compliance doesn’t fade after the audit is over.

Compliance Audit Process

A structured audit process keeps your organization compliant, uncovers gaps early, and prevents small issues from turning into big problems.

Different industries, different rules, different headaches. What works for a pharmaceutical company won't cut it for a bank. And what keeps a hospital compliant might be irrelevant for a tech startup. Each sector comes with its own audit priorities and regulatory requirements.

Pharmaceutical audits are high-stakes. The FDA, EMA, and WHO monitor every step because mistakes can directly affect patient safety. Pharma auditors focus on:

CGMP (Current Good Manufacturing Practice) assessments – Ensuring manufacturing follows strict standards; most FDA inspections find facilities compliant

Quality system audits – Checking documentation, training, and deviation handling

Process quality audits – Scrutinizing each manufacturing step for consistency

Product quality audits – Ensuring batch records and test results match promised standards

Pharma auditors must understand complex regulations while staying independent from operations.

Money makes the world go round, but it also attracts fraud. Financial auditors focus on:

Environmental auditors focus on compliance with environmental laws and internal initiatives:

Cybersecurity evolves daily, and IT auditors keep up with regulations and frameworks like:

Auditors constantly update technical knowledge, as yesterday’s fixes can become today’s vulnerabilities.

Healthcare auditors ensure providers follow regulations while safeguarding patients. They focus on:

Many healthcare auditors have clinical or health information management expertise, helping them understand both regulations and the realities of patient care.

Want the honest truth about becoming a compliance auditor? It’s not just checking boxes. Organizations with qualified auditors report 35% fewer regulatory violations. But here’s what job postings rarely tell you.

The basics matter:

The real differentiators are critical capabilities:

Technical skills find problems; communication ensures they get fixed. Fact: poor communication causes over 50% of audit remediation failures.

Written skills:

Verbal skills:

As a compliance director says: “Technical expertise identifies problems, but communication ensures they get fixed.” You can be the smartest person in the room—but if you can’t explain what’s broken and how to fix it, your expertise means nothing. Most auditors master the technical side; few master the human side. Be different.

Want to boost your earning power? Get certified. Professional certifications don’t just look good on your resume—they open doors to higher salaries and better opportunities. Research shows certified professionals can earn up to 25% more than non-certified peers.

Leading institutions offer structured paths to compliance expertise:

USC Compliance Certificate – Fully accredited by the Compliance Certification Board (CCB). Graduates can skip work experience requirements for CCB exams.

Pace University’s CCRP® Program – 80 hours of training in 26 sessions, led by real compliance veterans and academics.

IIA Compliance Auditing Course – Covers SOX, PCI, HIPAA, OFAC, ESG, and GDPR, bridging theory and workplace application.

These industry-recognized credentials prove your expertise:

Certified Internal Auditor (CIA) – The gold standard in internal auditing.

Certified Compliance and Ethics Professional (CCEP) – Focuses on compliance frameworks and ethics.

Certified Information Systems Auditor (CISA) – For IT systems and cybersecurity auditing.

Certified Risk Management Professional (CRMP) – Centers on spotting and managing risks.

Specialized certificates cover niche areas:

Certified HEDIS Compliance Auditor – Requires sponsorship; auditors complete two audits annually and six continuing education credits.

Certified Quality Auditor (CQA) – ANSI-approved under ISO 17024; education waivers can reduce experience requirements.

Regulations get more complex every year. These certifications give professionals the knowledge, credibility, and career edge they need. The real question isn’t whether you need certification—it’s which one you’ll pursue first.

Ready for some real talk about compliance auditor salaries? The numbers might surprise you.

The average compliance auditor earns between $68,732 and $74,164 annually in the United States. But here’s where it gets interesting — your industry choice can make or break your paycheck:

Some employers blow these averages out of the water:

Not too shabby for keeping companies honest, right?

Your years in the game directly impact your wallet:

Location matters too:

Independent compliance pros get serious flexibility:

These gigs usually want specialists in KYC, KYB, or AML operations with 5–8 years of experience.

The takeaway? Compliance auditing isn’t just about doing the right thing — it pays well too. Pick your industry, sharpen your skills, and explore flexible opportunities. Doing good and earning well can go hand in hand.

Are you ready to be the person who keeps organizations honest? Compliance auditors don’t just tick boxes—they catch problems before they become headlines, fines, or lawsuits. They ensure companies follow rules, protect reputations, and prevent costly mistakes.

This career isn’t for everyone. You need sharp analytical thinking, obsessive attention to detail, and communication skills that turn complex regulations into clear, actionable advice. Objectivity under pressure is essential, even when everyone wants you to look the other way.

The rewards are real. Salaries can reach six figures. Opportunities span healthcare, finance, tech, and more. You can work in-house, consult independently, or focus on niche areas. Certifications aren’t just for show—certified auditors earn up to 25% more and often get the best roles.

Compliance is growing fast. It’s not just about avoiding fines—it’s about building trust with stakeholders and keeping operations ethical and safe. You’re protecting consumers, investors, patients, and communities.

You’re part detective, part advisor, part teacher—finding gaps, recommending solutions, and helping organizations become stronger, safer, and more resilient from the inside out.

Take control of compliance, reduce risk, and build trust with UprootSecurity — where GRC becomes the bridge between checklists and real breach prevention.

→ Book a demo today

Senior Security Consultant