0%

Ever notice how most organizations treat risk management like an insurance policy they bought but never read? They know it’s important, but when push comes to shove, they’re crossing their fingers and hoping for the best.

Here’s the uncomfortable truth: 41% of organizations reported increased risk exposure in 2022. That’s not a trend—it’s a wake-up call. Threats lurk where you least expect them, and your business may not even see them coming.

Risk management isn’t just a corporate buzzword—it’s your organization’s immune system. Spot threats before they spot you. Figure out which ones could actually hurt you. Build your defenses before you need them. Stay alert, because threats evolve constantly, and yesterday’s solutions won’t solve tomorrow’s problems.

The companies that get this right reduce operational losses by 25% and respond faster. The ones that don’t? They end up as cautionary tales, paying the price for ignoring risk until it’s too late.

Risk management is how your organization spots danger before it hits—and ensures one mistake doesn’t become a catastrophe. It’s not a checklist or a compliance form; it’s a structured approach to identifying threats, analyzing impact, prioritizing what matters, and putting defenses in place. The goal isn’t just avoiding losses—it’s making smarter decisions and keeping your business steady.

Modern risk management spans several domains: IT risk, security risk, supply chain, third-party vendors, and industry-specific areas like healthcare compliance. Companies using frameworks like ISO 31000 or integrated governance, risk, and compliance practices can anticipate challenges, act fast, and protect both assets and reputation.

The difference between thriving and struggling organizations isn’t luck—it’s preparation. Effective risk management empowers you to foresee problems, respond efficiently, and maintain continuity across operations, vendors, and crises.

Think you know what threatens your business? Think again. Most organizations focus on the obvious: market downturns, competition, economic uncertainty. But the real threats? They’re hiding in plain sight, disguised as everyday operations.

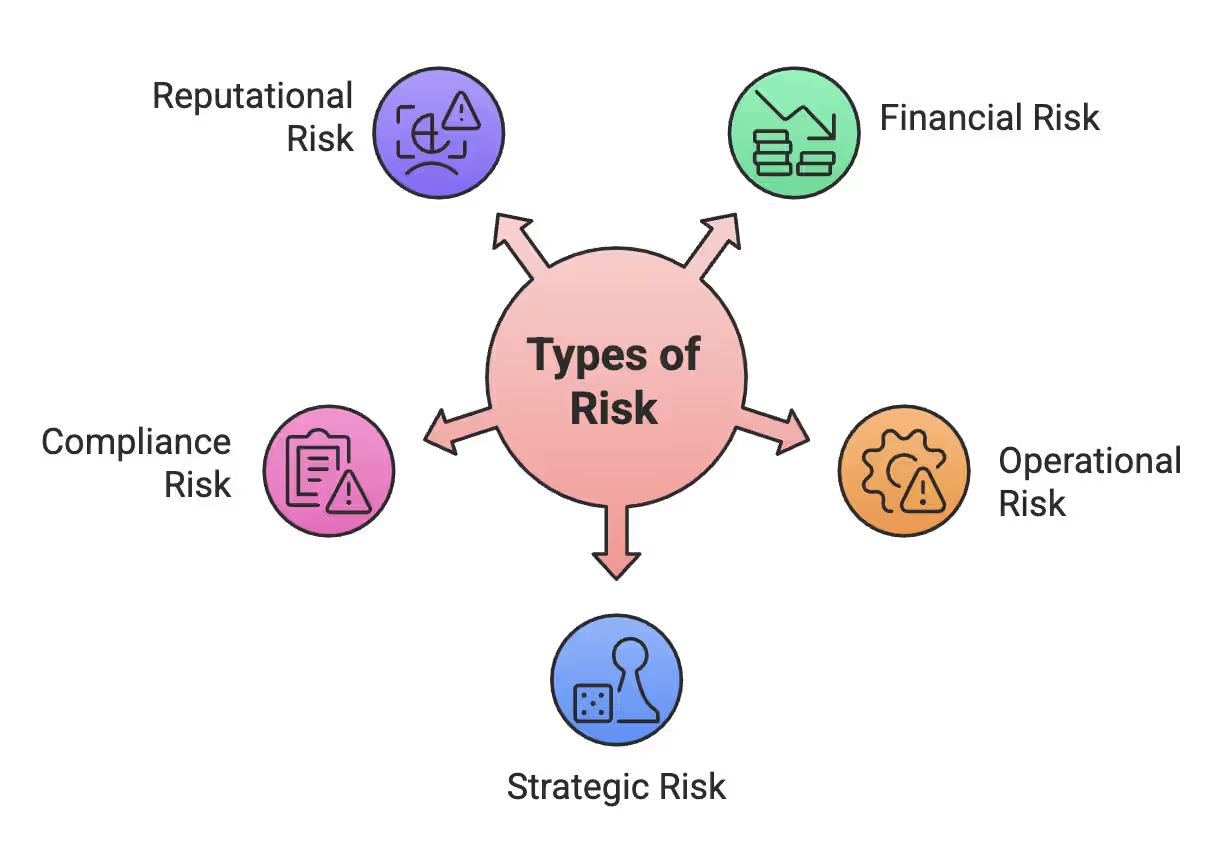

Here are the types of risks every organization should watch:

Types of Risk

Let’s get into these in detail.

Financial risk is all about money—and the ways it can slip through your fingers. On paper, your business may look solid, but unseen exposures can tank everything fast.

Even small financial issues can cascade fast. Awareness is your first defense.

Operational risk comes from within. Your systems, processes, and people can all backfire, often in ways you don’t anticipate.

Plan for mistakes. Resilience beats regret.

Strategic risk strikes when your plans go off course—or the market changes before you can react.

Adaptation is the key to surviving disruption.

Compliance risk is about breaking rules—regulatory, legal, or ethical—and paying the price.

Following the rules keeps your business safe.

Reputation is fragile. One mistake can ripple across your brand, trust, and finances.

Protect your reputation—it affects everything else.

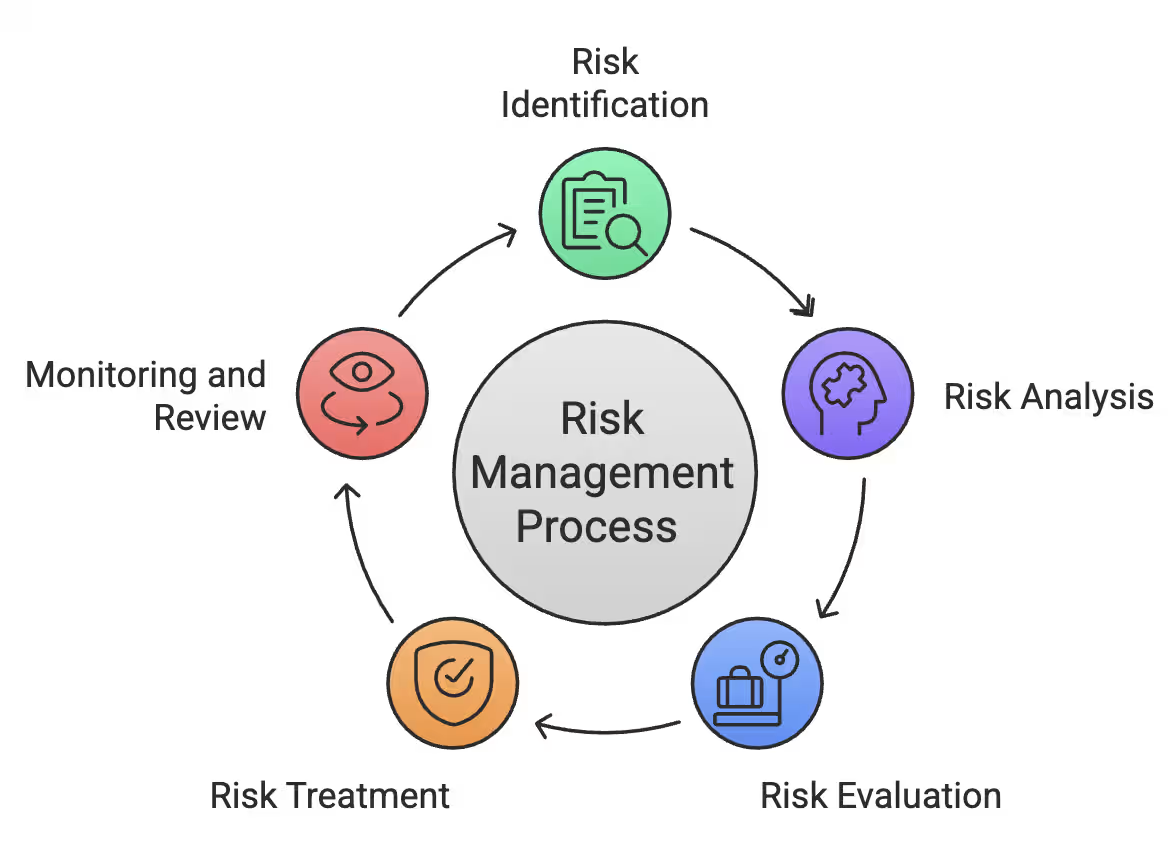

You’ve seen the numbers. You know the stakes. Now let’s talk about how to actually fix this mess. Risk management isn’t just a checklist—it’s the playbook organizations with 28% better performance actually follow. Miss a step, and you’re back to crossing fingers.

Here are the core steps of the risk management process:

Risk Management Process

Let’s get into these steps and see how they actually protect your business.

Every threat needs a name and a home. This is where your risk management journey begins. If you don’t know what could go wrong, you can’t protect against it. Document all risks in a risk register:

Companies with formal registers see 37% fewer surprises. Wing it, and you get blindsided repeatedly.

Once risks are identified, it’s time to understand them. Risk analysis measures the probability and potential impact of each threat, turning vague concerns into actionable insight:

Many organizations use a 5×5 matrix: red = act now, yellow = watch, green = noted. Simple. Clear. No guessing.

Not all risks are created equal. This step helps you decide which ones to tackle first and which can wait. Rank and prioritize based on:

This ensures your attention hits the biggest risks first, avoiding wasted time and effort.

Now comes the action. Risk treatment is where you decide how to respond to each risk, choosing the approach that fits your business and appetite for uncertainty:

Companies that implement structured treatment plans see 25% fewer incidents.

Risk isn’t static. Threats evolve, environments change, and controls can fail. Monitoring and review keeps your defenses sharp:

A dynamic approach turns risk management from “oh crap” into “we saw this coming and we’re ready.” That’s how organizations thrive, not just survive.

ERM isn’t just risk management—it builds systems for smarter decisions. Most companies treat it as a compliance checkbox, but integrating ERM with a unified GRC strategy lets organizations act faster and keeps boards fully informed.

Think of COSO as your organization’s operating system. You need these eight components to run risks properly:

Updated in 2017 to match a changing world.

Risk appetite isn’t bravado; it’s honesty. Most life sciences companies (67%) have missing or broken risk appetites—like driving blindfolded. Ask yourself:

Answering these isn’t optional—it’s fundamental to making smarter, more proactive business decisions.

Siloed GRC systems slow decisions and leave risks unaddressed. Problems include:

A unified GRC connects the dots and turns compliance into an advantage instead of a constant headache.

Comparing cyber, supply chain, and regulatory risks? You need a common language. Risk scoring lets you:

The goal isn’t perfect matrices—it’s focus on what really matters. Integrated ERM with GRC transforms risk management into a competitive edge, letting you make better decisions while competitors are still checking boxes.

Many businesses think risk is covered—security? Compliance? Done. Reality: risks don’t fit boxes. Siloed IT, procurement, and legal teams let threats multiply. Understanding specialized risk domains keeps organizations resilient.

IT risk management isn’t just buying software—it’s building a structured defense across all technology areas. Smart organizations focus on three pillars—the CIA triad:

Cover all three pillars to significantly reduce incidents. Missing one leaves gaps.

Supply chains are often an invisible weakness. Every disruption can ripple through operations, hurting revenue and reputation. Effective supply chain risk management evaluates traditional risks and ESG factors:

Ignoring these risks? Half of businesses operate blind to critical operational threats.

Many TPRM programs fail by treating all vendors the same. Smart programs classify and monitor high-risk vendors. Effective third party management protects your operations, prevents losses, and ensures compliance.

Good TPRM turns potential disasters into manageable risks.

Security risk management is essential. Data breaches cost $4.45M on average. Strong programs combine assessment, prevention, and monitoring. Without proactive security, organizations face repeated attacks, financial losses, and reputation damage.

Skipping the first step? Expect repeated incidents.

Healthcare risk management faces unique challenges, especially around HIPAA compliance. Patient safety and data privacy demand specialized attention beyond standard organizational risk practices.

Over 176M U.S. patients affected—mostly due to employee negligence. Generic approaches won’t cut it.

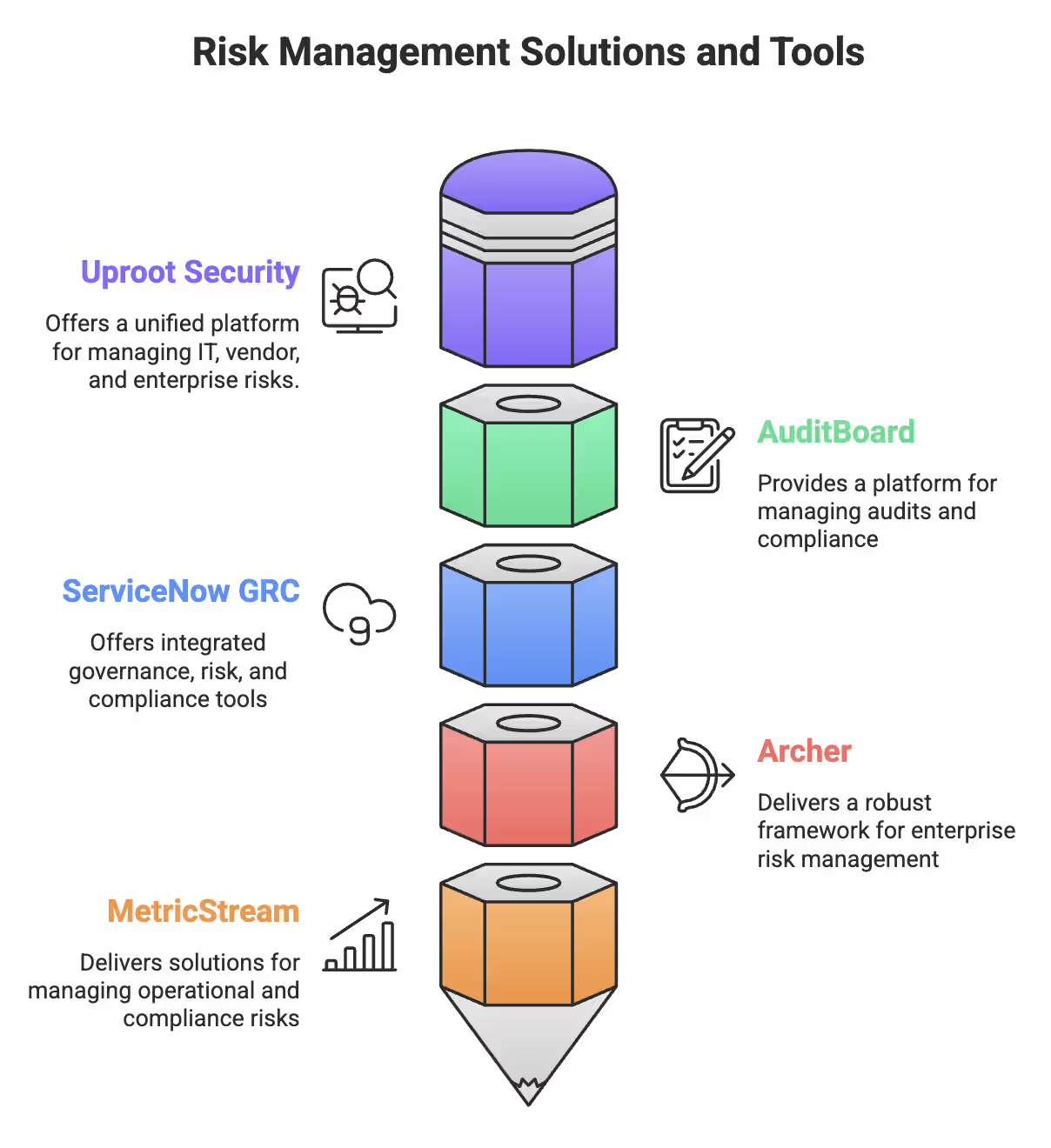

Spotting risks isn’t enough. The right platforms automate monitoring, provide real-time insights, strengthen vendor risk management and enterprise risk management, reduce manual work, and help teams act fast before small problems escalate.

Risk Management Solutions and Tools

These are some of the top risk management tools and platforms:

Uproot Security unifies IT, vendor, and enterprise risks with clarity.

Turns scattered risk data into actionable insights for faster decisions.

AuditBoard simplifies enterprise risk and compliance for smarter workflows.

Reduces blind spots and makes integrated risk management seamless.

ServiceNow GRC automates assessments and integrates IT with business systems.

Ensures risk processes stay efficient and responsive.

Archer provides enterprise-wide visibility and actionable insights.

Helps organizations anticipate and mitigate risks effectively.

MetricStream delivers dashboards, analytics, and reporting for enterprise and vendor risks.

Provides clarity, control, and smarter enterprise risk decisions.

These platforms turn risk data into actionable insights, automate tasks, and give leadership a clear view of vendor and enterprise risks, helping organizations respond faster and reduce surprises.

Fancy software alone won’t protect you. A strong risk culture embeds awareness into daily decisions, making everyone responsible. Organizations doing this see 28% fewer incidents and faster recovery.

Most risk training is boring, so people tune out. What actually works:

Finance doesn’t need ISO lectures—they need to spot vendor red flags. IT needs actionable steps for system failures.

Tested incident response plans help organizations respond 75% faster during disruptions. Effective testing includes:

Experts say: “Practicing your plan in real-time is the only way to know it works.”

Risks don’t respect departmental boundaries. Siloed teams miss connections, cascading effects, and hidden threats.

Key steps for cross-functional collaboration:

When teams collaborate, risks are spotted early and handled effectively.

ESG factors carry real consequences:

It’s not about annual reports—it’s about real operational and reputational risks.

Zero Trust flips security assumptions:

Organizations using Zero Trust align security with risk response strategies: tolerate, operate, monitor, improve.

Risk management isn’t going anywhere—and neither are the threats your organization faces. You can’t eliminate risk; anyone who says otherwise is selling something. What you can do? Make smarter bets. Companies that get it right see 25% fewer operational losses and respond 75% faster when problems arise.

Frameworks like ISO 31000 work because they’re systematic—no guesswork, no crossing fingers. Digital tools have transformed the game. Integrated risk management platforms reveal patterns, highlight connections, and help you act before small problems snowball.

But here’s the catch: tools alone aren’t enough. Strong risk awareness across teams reduces incidents by 28%. It’s not fear—it’s awareness. Everyone becomes part of the solution.

Risk landscapes evolve. Technology changes, regulations shift, expectations rise. The goalposts never stop moving. Done right, risk management isn’t just defense—it’s smart play. Informed decisions turn uncertainty from a liability into a strategic advantage, helping your organization thrive even under pressure.

Master risk, protect your business, and turn uncertainty into advantage with UprootSecurity — where risk management solutions make every decision smarter.

→ Book a demo today

Senior Security Consultant