0%

Ever wondered why payment security feels like navigating a maze blindfolded? You’re not alone. PCI DSS isn’t just another acronym floating around in the payments world—it’s the rulebook that keeps cardholder data safe from the bad guys.

It was born in 2006 from the collective muscle of Visa, Mastercard, American Express, Discover, and JCB. What started as a shared standard quickly became the backbone of modern payment security.

And if you’re running a fintech startup? Understanding PCI DSS isn’t optional. It’s survival. Sixty percent of small businesses hit by cyberattacks shut down within six months. And in 2023 alone, over 63% of fintech breaches involved stolen payment card data—usually because basic security controls were missing.

The part most founders underestimate? PCI DSS applies to anyone touching card data—processors, digital wallets, BNPL platforms, mobile payment apps. Even if you outsource payments, you’re still responsible for keeping your environment compliant.

But here’s the upside: build PCI controls early, and you’re not just checking a box. You’re laying the groundwork for secure, scalable growth—without the constant fear of the next breach.

If your startup touches card data, PCI DSS isn’t optional. It’s the rulebook you can’t ignore. Not a law—but banks and card networks treat it like one.

The moment you accept, process, store, or transmit cards, PCI requirements kick in. Size, funding stage, or age of your startup doesn’t matter. Skip it, and the fallout is real: fines, audits, higher processing fees, or frozen accounts.

Outsourcing payments helps, but it doesn’t hand off responsibility. Stripe, Razorpay, or another gateway may reduce scope—but accountability stays with you. Every card, every access point, every server storing data—that’s on your startup. Shared-responsibility gaps are where most early-stage fintechs stumble.

Startups that embed PCI requirements early don’t just survive. They move faster, earn trust sooner, and scale without painful security headaches. Compliance becomes a growth engine, not a roadblock.

PCI DSS sounds intimidating, but at its core, it’s a practical framework for protecting payment card data anywhere it lives, moves, or gets processed. It’s not government law, but banks and card networks treat it as non-negotiable. If you accept, store, process, or transmit card information in any form, you’re automatically in scope.

For fintech startups, PCI DSS matters for one reason: your business runs on trust. Investors expect it. Partners demand it. Customers assume it. Skip compliance and you’re staring at penalties from $5,000 to $100,000 per month, plus breach costs that can easily climb into the millions.

The standard outlines 12 requirements across six pillars—network security, data protection, vulnerability management, access control, monitoring, and policies. Yes, it can feel heavy. But startups that integrate these controls from the start turn PCI DSS into an advantage, not a roadblock. It becomes the guardrail protecting your product, your customers, and your credibility as you scale.

Look, you can’t jump into PCI compliance blindly. Three things determine what you’re actually on the hook for: how your business operates, how many transactions you process, and how you handle cardholder data. Get this wrong and you’ll either overpay for compliance you don’t need—or underprepare for what’s coming.

Merchants take card payments directly from customers for what they sell. Your fintech app charging subscriptions? That’s merchant territory. You’ll need to secure your payment setup and work with acquiring banks for a Merchant Identification Number (MID).

Service providers handle cardholder data for other businesses. Payment processors, gateways, and fraud tools—if you make transactions happen for someone else, you’re a service provider. Even if you don’t directly touch the data but can influence its security, you still qualify.

Here’s the twist: you might be both if you process your own payments and handle transactions for others.

Your 12-month transaction count decides your compliance level.

For merchants:

For service providers:

Been breached? You’re automatically bumped higher. The industry doesn’t forget.

Your Cardholder Data Environment (CDE) includes every system, person, and process that touches cardholder data or sensitive authentication info. Assume everything is in scope until proven otherwise—it saves headaches later.

Your CDE usually includes:

Network segmentation isn’t required, but skipping it is costly. Without it, your entire network falls under PCI scope—slow, expensive, and overkill. Smart segmentation isolates what matters and reduces compliance effort.

Map every data flow. Track where cardholder data enters, moves, and leaves your environment. This isn’t just paperwork—it’s the foundation of efficient, cost-effective PCI compliance. Do it right now, and future audits and security checks become far simpler.

PCI DSS compliance isn’t something you scramble for at the last minute. It’s a structured process that demands planning, documentation, and continuous oversight. For fintech startups, getting this wrong means delays, rework, and potential audit failure.

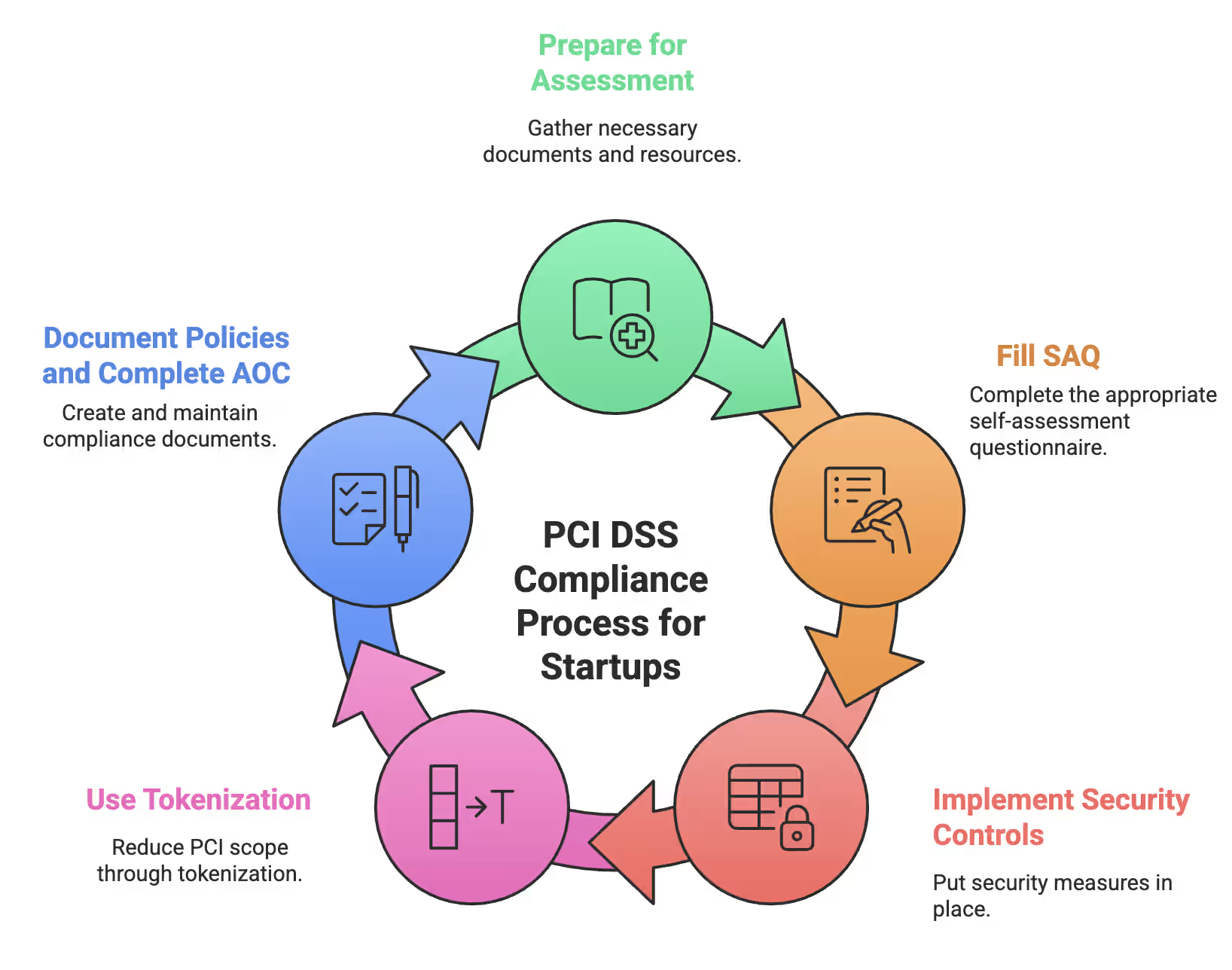

These are the steps to get your startup PCI DSS compliant:

PCI DSS Compliance Process for Startups

Let’s get into each of these:

PCI DSS compliance isn’t something you scramble for at the last minute. Early preparation means documenting what matters before auditors ask for it:

Run internal checks using SANS PCI checklists to surface gaps early. Bring in Qualified Security Assessors (QSAs) early to align expectations and avoid surprises.

Most early-stage fintechs complete an SAQ instead of a full audit. Your setup determines the type:

Cross 6 million annual transactions and you’ll graduate to a full Report on Compliance (ROC). Expect stricter verification, deeper evidence reviews, and more back-and-forth with QSAs.

PCI DSS requires strong technical foundations. Core controls include:

These controls demonstrate your environment is secured, monitored, and resilient to common attack vectors.

Tokenization removes real card data from your systems, which directly reduces PCI scope by:

The result is fewer systems in scope, faster audits, and lower long-term compliance effort.

PCI DSS also demands formal documentation and executive ownership, supported by policies covering:

The Attestation of Compliance is signed by leadership and valid for 12 months. Submitting it signals operational maturity and builds trust with banks and partners.

Manual PCI DSS compliance is a time sink. Endless screenshots, spreadsheets, and chasing people for evidence—it drains your team when you should be building product. This is where PCI compliance automation comes in, transforming tedious tasks into seamless workflows.

PCI DSS automation flips the entire model. One Fortune 500 fintech cut compliance hours by 80% without replacing their GRC tools. How?

The real win isn’t fancy tooling—it’s systems that generate their own evidence. Add tests, logs, and checks directly into your engineering workflows, and every deployment becomes an audit-ready artifact. As one expert puts it: “For an audit, you just grab the latest run—that’s your evidence.” Clean. Simple. Repeatable.

Continuous monitoring is where automation really earns its keep. Continuous Controls Monitoring (CCM) watches your environment round the clock, catching vulnerabilities, misconfigurations, and unauthorized changes instantly. Automated log monitoring adds another layer—analyzing events across your stack to flag anomalies before attackers can move.

PCI DSS even encourages this. Requirement 10.6 explicitly allows automated log harvesting and alerting. With real-time alerts, compliance violations don’t simmer quietly—they surface instantly.

No more audit-week panic. No more retroactive fixes.

Just a smooth, always-on compliance engine that scales with your fintech.

Automation isn’t a luxury anymore—it’s the edge that lets fast-moving fintechs grow without drowning in compliance tasks. While others lose weeks to manual evidence collection, automated teams stay focused on product, customers, and security.

All those screenshots, spreadsheets, and reminder pings? Gone. Automation cuts human effort by up to 80%, enables full-population testing, and automates dozens of PCI controls without scaling headcount. Your security team stops doing admin work and starts doing real security—minus the human errors that derail audits.

Security isn’t a quarterly event. Automation gives you 24/7 visibility: instant alerts, File Integrity Monitoring across critical systems, and Continuous Controls Monitoring that tracks drift the moment it happens. You’re not guessing anymore—you know when something breaks.

Audit season becomes painless. Evidence is collected automatically, reports generate themselves, and dashboards show your compliance status in real time. What once took months now takes weeks, with cleaner documentation and fewer surprises.

Automation doesn’t just save time—it hardens your entire environment. It also strengthens fintech data security, ensuring sensitive cardholder information is protected at every stage. You get early detection of vulnerabilities, continuous enforcement of access and encryption controls, and stronger protection across your CDE.

Your competitors react slowly. You move instantly.

Picking the right PCI compliance tool is a high-stakes decision. Get it wrong and you’re stuck with painful audits, endless manual work, and fines that can hit $100,000 per month. Get it right and PCI becomes a smooth, automated background process while your team stays focused on building product—not chasing screenshots.

A solid PCI compliance tool should lift the operational burden from day one and keep your payment environment secure without constant hand-holding. Here’s what that looks like:

Get these five right, and PCI compliance stops being chaos—and starts becoming predictable.

Not every PCI platform solves the same problem. Some excel at ease of use, others at deep technical checks, and some are built for long-term scalability. Here’s the breakdown—clear, honest, and focused on what actually matters for fintech teams:

Secureframe is built for startups that want PCI compliance without complexity slowing them down.

Scrut is the most PCI-centric platform, engineered specifically around PCI DSS 4.0’s technical demands.

Hyperproof stands out for teams planning to scale across multiple certifications.

Go with the tool that matches your growth curve—not just the one with the flashiest features.

Automation helps—but fintech comes with challenges that don’t vanish just because you bought a shiny tool.

Vulnerability scanners love crying wolf. Your team chases “critical issues” that aren’t real—while actual threats slip by. Routine scans aren’t foolproof. In 2023, over 63% of fintech breaches still involved stolen card data. False positives drain time. Real threats sneak past.

How to fix it:

Developers push code fast. Compliance wants guardrails. Both are right—but both can clash. And with small businesses folding within six months of a cyberattack, speed can’t come at the cost of security.

How to balance both:

Security isn’t just an engineering problem—it’s an everyone problem. One careless click can undo even the strongest tech stack.

Your action plan:

Security isn’t a destination. It’s a habit.

PCI DSS compliance isn’t your enemy—it’s your competitive edge. For startups, it might feel overwhelming: determine if you’re a merchant, service provider, or both, map transaction volumes, define your cardholder data environment, document everything, and implement proper security controls.

The difference between winners and casualties? Treat compliance as infrastructure, not overhead. Automation changes the game: real-time monitoring and automated workflows free teams to focus on building products, not chasing audits. Choosing the right tool can make PCI DSS compliance more manageable, whether you prioritize usability, deeper technical checks, or multi-framework support—pick what fits your startup’s needs.

Challenges like false positives, balancing speed with security, or team misalignment are solvable. Configure scanners properly, integrate security into development workflows, and train your team consistently.

PCI DSS is more than a checkbox—it’s trust. Companies that embed it early move faster, win bigger deals, and scale securely. In a landscape of rising customer expectations and regulatory scrutiny, startups that build clean, secure, and smart from day one gain a lasting advantage.

Take control of compliance, reduce risk, and build trust with UprootSecurity—where GRC turns policies and processes into real breach prevention.

→ Book a demo today

Senior Security Consultant