0%

Ever wonder why some companies dodge disasters while others get blindsided by threats they never saw coming? The difference isn’t luck—it’s risk scores. These numbers aren’t just metrics; they show the risks hiding in plain sight before they hit.

Think of risk scores as your organization’s threat radar. They take messy, complicated risks swirling around your business—financial, operational, or cybersecurity—and turn them into a single number. Higher numbers, bigger problems. Simple but powerful.

Why care? Flying blind is expensive. Banks use risk scores to decide who gets a loan. Hospitals use them to keep patients safe. Cybersecurity teams rely on them to spot vulnerabilities before hackers do. Even compliance teams use them to avoid fines or breaches.

Risk scores show which fires to put out first, get everyone speaking the same language about threats, guide fact-based decisions, allocate budgets wisely, and keep regulators satisfied. Without them, you’re throwing darts blindfolded.

A risk score is a numerical representation of potential threats to your organization. It takes messy, complex risks—from cybersecurity gaps to operational weaknesses—and turns them into a single number you can understand. Higher scores mean higher risk; lower scores indicate less danger.

Think of it like a dashboard for decision-making. Instead of guessing which risks are urgent, risk scores highlight the areas that need attention first. They create a shared language across teams, so finance, security, and operations can all agree on what’s truly critical.

Risk scores aren’t pulled from thin air. They’re calculated using data, historical trends, and statistical models. This can include metrics like vulnerability severity, likelihood of fraud, vendor reliability, or potential financial impact. Regular updates keep the score accurate as conditions change.

The best risk scores are clear, actionable, and easy to interpret. They help organizations prioritize efforts, allocate resources wisely, and make informed decisions—turning uncertainty into manageable, measurable actions.

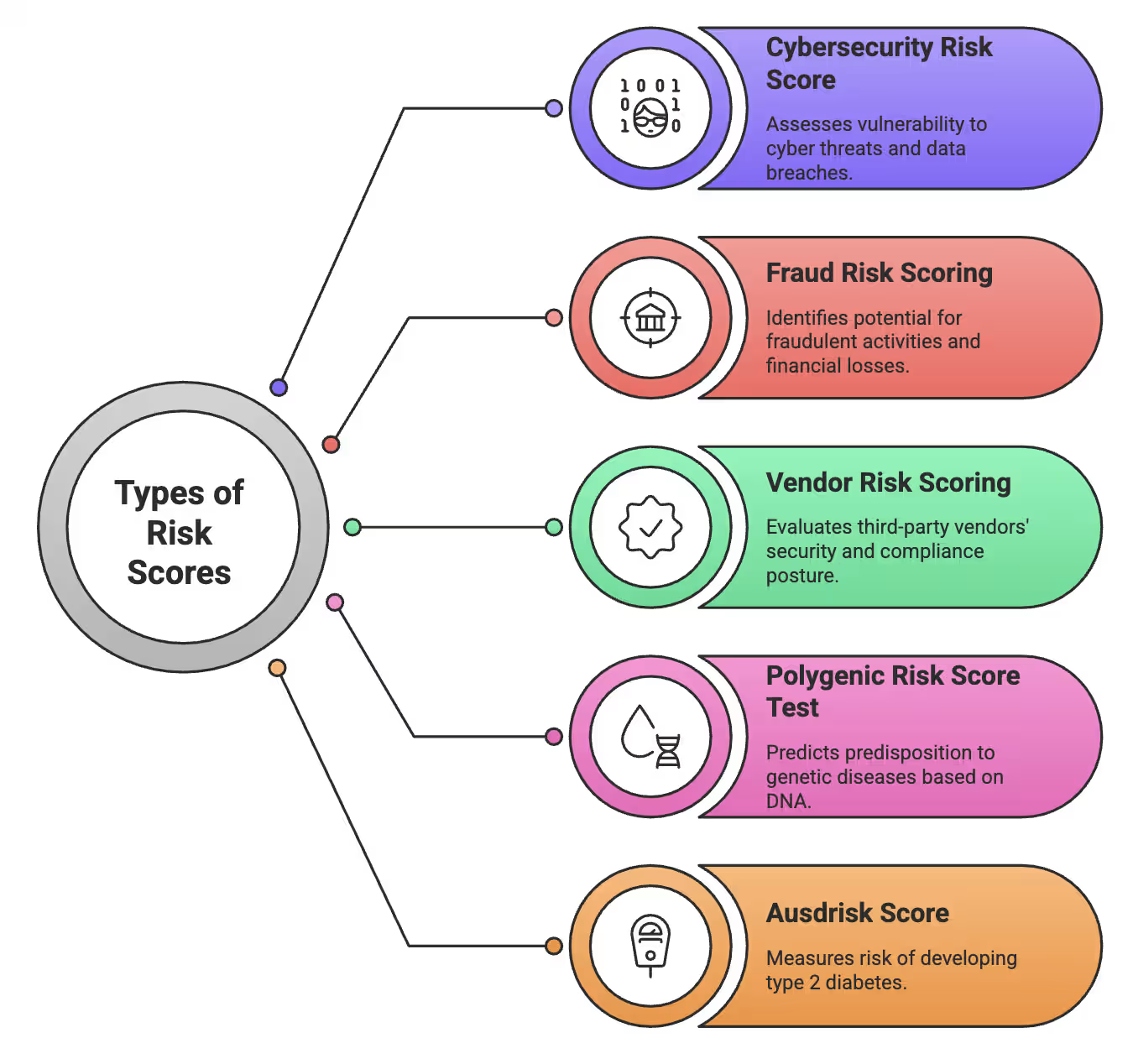

Not all risks are created equal. And neither are the scores that measure them. Each industry has its own flavor of chaos. Banks worry about credit defaults. Hospitals focus on patient safety. Tech companies lose sleep over data breaches. Understanding the different types of risk scores helps you turn complex threats into clear numbers and actionable decisions.

The main types of risk scores are:

Types of Risk Scores

Let’s get into each of these and see what they actually do for you.

This is your security team’s best friend. Cybersecurity risk scores turn digital vulnerabilities into hard numbers. They help you:

NIST breaks it down: Risk = Threat Source → Threat Event → Vulnerability → Predisposing Conditions → Impact. It basically means “here’s how badly things can go wrong, step by step.”

Fraud scores act like a digital bouncer for online transactions. They help you:

Banks use these to catch unusual activity—like five large purchases at 3 AM.

Third-party vendors can be your weakest link. Vendor risk scoring tells you:

Most companies use a Gaussian-weighted mean, meaning the worst issues get the most attention and get prioritized for action.

PRS looks at your genes to predict disease risk. It:

Polygenic risk scores turn complex genetics into actionable health insights.

Australia’s 10-question test predicts diabetes risk over five years. It asks about:

Score 12+? Time to pay attention. Score 20+? One in three people like you may develop diabetes.

Look, you don’t need a PhD to understand risk scores. The basic formula is simple:

Risk Score = Likelihood × Impact

How likely is something bad to happen? How much will it hurt if it does? Multiply those together and you’ve got your number. Easy.

Some teams love numbers, others trust their gut. Smart organizations use both.

Qualitative models rely on expert judgment and terms like low, medium, high. Perfect for brand-new threats or when data is scarce.

Quantitative models crunch hard numbers using historical data and stats. Calculating Annual Loss Expectancy (ALE)? This approach shows exactly how much money you might lose over a year.

Most successful organizations blend both—numbers where possible, judgment where needed.

NIST gives a solid foundation for risk scoring:

This makes it easy to compare risks across systems—like email versus databases—apples to apples.

NIST Cybersecurity Framework scorecards turn technical metrics into business language. They show:

Scorecards make technical risks clear and actionable for business decisions.

When rating vendors, many systems use a Gaussian-weighted mean. Fancy name, simple idea: the worst problems get the most attention.

Ensures the most critical vendor issues get addressed first.

Risk scores are meaningless without thresholds. Clear rules matter:

Set thresholds to match your risk appetite—how much risk your organization is willing to tolerate. Otherwise, your controls are just expensive paperwork.

Different industries face different threats. Different threats need different scores. Risk scores aren’t just numbers—they’re your decision-making compass. They tell you where to focus, how much to invest, and what might go wrong if you ignore them.

Risk scores aren’t meaningful until you tie them to real outcomes. A number on a spreadsheet doesn’t pay the bills, but knowing what that number means for revenue, compliance, or operations does.

By mapping scores to impact, you can prioritize efforts and spend your resources where they actually matter.

Numbers don’t lie—but only if you know how to interpret them. Quantitative models like FAIR (Factor Analysis of Information Risk) and CRQ (Cyber Risk Quantification) help:

This approach removes guesswork and gives executives something concrete to act on.

Operational metrics bring context to your scores. They let you track how well you’re actually managing risks:

These metrics turn abstract numbers into actionable insights, highlighting weak spots and measuring improvement over time.

Scorecards translate raw risk numbers into business language. They show:

NIST’s Cybersecurity Framework adds a layer of standardization, making it easier to compare risks across systems and departments. Scorecards turn technical data into decisions your leadership team can understand and act on.

Having risk scores is one thing. Using them effectively? That’s where most organizations stumble. Risk scores aren’t just numbers—they’re decision-making tools. They show where to focus, how to allocate resources, and how to protect your business before things go sideways.

Smart organizations don’t treat cybersecurity and fraud as separate problems. They connect the dots.

Transparency across teams isn’t fancy—it’s survival. Fraud teams and cybersecurity teams need to share insights immediately because threats don’t operate in silos.

Not knowing which vendors are risky is worse than having risky ones. Vendor risk scoring is about survival, not paperwork.

This is especially critical in healthcare, finance, and regulated industries.

CISOs constantly ask: “Are we secure?” and “What are the risks?” Scorecards answer both—clearly.

Scorecards turn complex security data into clear insights that drive decisions and keep your organization audit-ready.

Compliance tools don’t have to feel like punishment. The best GRC platforms act like superpowers.

At the end of the day, every risky conversation comes down to one question: “What’s this going to cost us?”

When risk scores are measured, interpreted, and applied effectively, they stop being abstract numbers and start driving smart, actionable decisions that protect your organization, your people, and your bottom line.

You’ve got the scores. Now what? Numbers alone don’t protect your business—they just show where the problems are. The real value comes from acting on them. This section walks through strategies that turn raw scores into real, measurable improvements.

When vendors score poorly, shrugging isn’t an option. Smart companies turn those scores into action. Automated workflows assign tasks to the right teams, set clear deadlines, and give vendors portals to prove issues are fixed. No more “we’ll get to it eventually.” Either the problem gets resolved or the vendor gets replaced. This approach keeps your supply chain secure and accountability clear.

Catching fraud after the fact is too late. Organizations track user behavior in real time, spotting suspicious activity before transactions complete. Machine learning detects fraud in milliseconds, blocking the majority of attempts without alerting customers. Proactive monitoring turns risk scores into prevention, protecting both your money and reputation while keeping operations smooth.

Many security teams struggle to prioritize vulnerabilities. Risk-based patching focuses on the flaws that truly matter, using AI to filter out the noise. Patching everything is impossible, but patching the right things prevents incidents, reduces downtime, and optimizes resource use. This ensures security investments are focused where they have the most impact.

Employees are either your weakest link or strongest defense. Effective training reduces successful phishing attacks by up to 90% and drives measurable ROI. Tracking key metrics—like reported suspicious emails, containment speed, and repeat mistakes—turns your workforce into a proactive security asset.

Risk scores aren’t perfect. Pretending they are is dangerous. Understanding their limits is just as important as knowing their strengths.

Most risk assessments are snapshots, not living measurements. Today’s score can be obsolete tomorrow. Traditional models treat everyone the same, missing behavior changes, emerging threats, or shifting regulations. Your risk landscape moves faster than your scoring system updates—and hackers notice.

False alarms drain attention and trust. Fraud systems flag harmless transactions, cybersecurity tools panic over every update. Teams start ignoring alerts, and the real threats slip through. Time wasted chasing ghosts means less time stopping real attacks. When your tools cry wolf too often, confidence evaporates.

External ratings only tell half the story. They can’t see internal quirks, rogue servers, or outdated software tucked away in a corner. Relying solely on outsiders is like self-diagnosing with WebMD—you’ll miss the critical stuff that makes your organization unique.

Treating numbers like gospel is a trap. A “7” in accounting doesn’t equal a “7” in warehouse operations. Scores ignore context, human judgment, and complex internal relationships. They’re tools, not crystal balls. Used wisely, they guide decisions. Used blindly, they mislead.

Understanding these limitations ensures risk scores remain a compass, not a crutch, helping you make smarter, more informed decisions without being fooled by the numbers.

Look, we’ve covered a lot. Risk scores help you spot problems before they blow up. They turn confusing threats into clear numbers and show you where to spend your resources wisely.

But let’s be real—they’re not perfect. Sometimes they miss things. Sometimes they raise false alarms. The best organizations don’t treat them like crystal balls. They use scores alongside human judgment, industry knowledge, and common sense.

Start small. Pick an area—cybersecurity, vendor management, or fraud prevention. Build a simple scoring system, make it work, then expand. Behavioral analytics prevent 90% of fraud attempts. Solid security training can deliver ROI up to 562%. The data doesn’t lie.

Risk scores aren’t going away—they’re getting smarter and faster every year. Effective risk management isn’t about avoiding every threat. It’s about making smart choices with the information you have. Risk scores give you that clarity. What you do next is up to you.

Turn your risk insights into action, reduce vulnerabilities, and keep your organization secure with UprootSecurity.

→ Book a demo today

Senior Security Consultant