0%

Ever feel like your compliance team is drowning in paperwork while regulations keep multiplying? You’re not alone. Most organizations spend 15–20% of their operational budget just keeping up with compliance. That’s millions sunk into manual reviews, endless documentation, and playing catch-up with ever-changing rules.

But here’s the game-changer: AI agents for compliance. This shift toward compliance using AI is redefining how organizations manage regulatory risk at scale. These aren’t basic chatbots or simple automation scripts. We’re talking about intelligent software that can interpret complex regulations, reason through scenarios, and make decisions—all without constant human oversight.

The impact is staggering. Companies using AI agents cut compliance costs by over 40% while improving regulatory coverage and accelerating response times. Take Amazon: they process 2 billion transactions daily across 160+ businesses, powered by AI-driven compliance screening.

How do they do it? Four capabilities: natural language understanding to decode regulations, decision-making beyond simple rules, integration with existing enterprise tools, and smart escalation when human judgment is needed.

The result? Compliance that’s faster, smarter, and less costly—finally letting your team focus on strategy instead of paperwork.

AI agents for compliance are specialized software designed to act like a virtual compliance team. These AI compliance agents monitor, advise, act, and audit—all in real time. These agents don’t just follow pre-set rules; they understand regulations, reason through scenarios, and make decisions where appropriate, escalating to humans only when needed.

Think of it as building your compliance dream team: monitoring agents track regulatory changes and control effectiveness 24/7. Advisory agents provide instant policy guidance with proper citations. Action agents handle workflow orchestration and reporting. Audit agents compile evidence and generate audit-ready documentation without manual intervention.

Under the hood, this magic happens through a structured process: data ingestion, retrieval-augmented generation, policy evaluation, tool integration, and human-in-the-loop review. Sounds complex? It is—but that complexity brings both autonomy and accountability.

The payoff: real-time enforcement, scalability without added headcount, and full explainability for auditors. Companies can finally shift from reactive fire-fighting to proactive, intelligent compliance management, letting teams focus on what they do best.

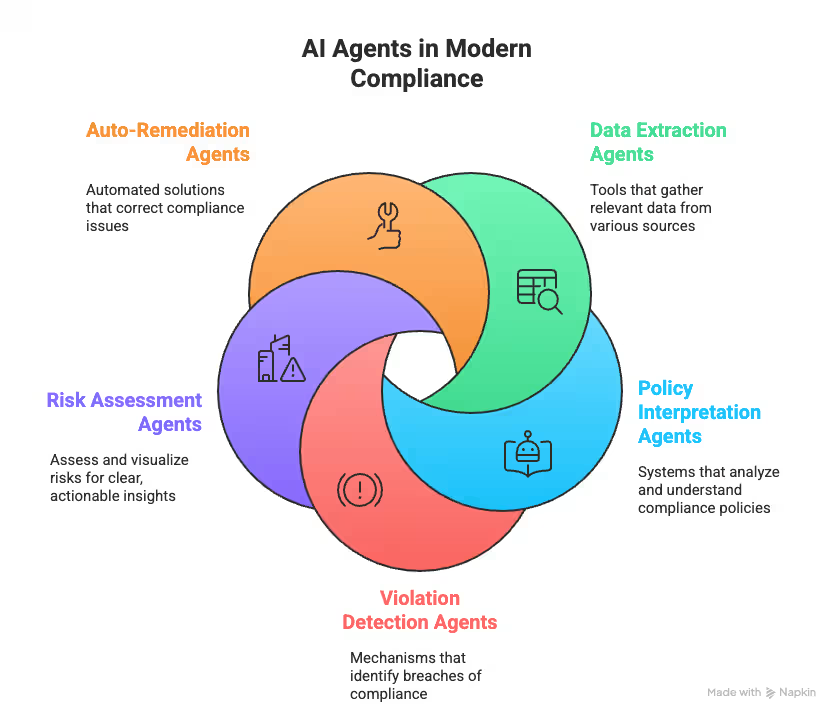

Think of modern compliance AI agents like a well-orchestrated team where each member has a specific job—except they never take coffee breaks and work with machine precision. These components work together, forming an integrated system that manages the full compliance lifecycle.

AI Agents in Modern Compliance

Data extraction agents are the system’s eyes and ears. They handle:

They go beyond OCR, using advanced layout recognition and image interpretation. Financial institutions cut manual document processing by up to 90% while achieving higher accuracy than human teams.

Once data is extracted, policy interpretation agents step in. They use:

Frameworks like NIST AI Risk Management show how these agents map requirements to controls. Systems like ARPaCCino can even translate natural language policies into formal rules computers can evaluate.

Detection agents ensure constant vigilance:

A financial firm with a 200-seat call center detected 4,127 violations annually versus 127 using traditional sampling—a 32x improvement.

Risk assessment agents ensure clarity and accountability:

These agents make risk evaluation transparent, traceable, and easy for teams and auditors to understand.

These agents handle what happens next:

Advanced auto-remediation resolves up to 95% of Tier-1 issues without human intervention, cutting response times while keeping enforcement consistent.

This architecture transforms compliance from periodic check-ups into a continuous, AI-powered ecosystem—because compliance problems don’t wait for your next audit cycle.

Security teams used to scramble for SOC 2 compliance, tracking controls, gathering evidence, and prepping for audits manually. It’s tedious, error-prone, and stressful. AI agents change the game—continuous monitoring, automated evidence collection, and real-time control validation make SOC 2 readiness ongoing, proactive, and way less chaotic.

SOC 2 compliance creates mountains of logs, user activity data, and system events. Human teams often drown in false positives. AI agents cut through the noise by:

The result: teams focus on actual risks instead of chasing irrelevant alerts, reducing time wastage and burnout.

Preparing for SOC 2 audits is tedious without automation. AI agents streamline the process by:

This ensures documentation is always audit-ready, gaps are flagged immediately, and teams avoid last-minute scramble or human errors.

SOC 2 audits used to be point-in-time, leaving organizations exposed between checks. AI agents transform compliance into a continuous process by:

Teams save weeks of manual work, maintain real-time readiness, and focus on strengthening controls. Compliance shifts from reactive firefighting to proactive, always-on assurance, ensuring organizations are audit-ready at any moment.

Let’s get real: every industry has its compliance nightmares, and AI agents are stepping in to clean up the mess. From banking to healthcare, insurance, retail, and energy, intelligent software is transforming how organizations manage rules, audits, and risk.

Banks bleed money from compliance failures—USD 26 billion in AML/KYC fines globally. AI agents help by:

The kicker? Many corporate banks still pay $1,500-$3,000 per individual KYC review, burning through millions annually. AI drastically cuts costs while improving coverage and response speed.

Healthcare has topped global data breach costs for 12 consecutive years. AI agents tackle this by:

Exposure risks are flagged early—before they become reportable breaches.

Insurance compliance is notoriously messy. AI agents bring clarity by:

No more missed details or endless document shuffling.

Trust drives business—84% of consumers are more likely to buy from companies that handle data responsibly. AI helps by:

Data protection stays automatic, consistent, and scalable across regions.

SOX compliance used to be a guessing game with sample testing. AI agents now enable:

Continuous monitoring replaces guesswork with real-time control assurance.

The bottom line? AI shifts compliance from reactive to proactive. Instead of constantly playing defense, organizations prevent violations before they happen—and that changes everything.

The proof is in the performance. AI in compliance management doesn’t just promise change—it delivers measurable results, turning compliance from a cost drain into a competitive edge.

Quarterly reviews? Ancient history. AI-powered systems work 24/7, analyzing transactions, communications, and activities. Nothing slips through cracks between audits. They scan new regulations automatically, map them to your business processes, update workflows, and even predict risks before they become issues. It’s like a crystal ball that actually works.

Financial institutions face false positive rates as high as 90%. Teams waste time chasing fake alerts while real issues hide. AI changes that with advanced analysis techniques, filtering out around 93% of false positives. Analysts finally focus on real compliance threats, saving time and reducing burnout.

Audit panic? Gone. AI compresses weeks of preparation into hours by continuously testing controls, packaging evidence automatically, and alerting teams when deviations occur. Audit readiness becomes the default, not a twice-yearly scramble.

Growing compliance demands no longer mean hiring more analysts. AI reduces evidence collection time by 75%, cuts manual audit touchpoints by 90%, and detects 95% of potential issues before they become findings. Your compliance function scales with your business, turning risk management into a strategic advantage.

Let’s not sugarcoat it. AI agents for compliance face real hurdles, and you need to know them upfront. If someone tells you it’s all smooth sailing, they’re probably selling something.

AI systems are data-hungry. They need massive volumes to function, which increases privacy exposure and creates new breach points. Employees accidentally feeding confidential info into AI tools—about 11% of the time—is a real concern. Add in threats like data poisoning attacks on training sets, and suddenly your AI is making decisions based on corrupted data.

Automation bias is real. Even skilled operators often rubber-stamp AI recommendations because computers convey confidence. Effective oversight requires interfaces that let humans intervene and confidence scores that flag issues. Oversight must be actionable, ensuring AI supports decisions while human judgment remains central to compliance operations.

Most AI algorithms are black boxes: data goes in, decisions come out, and regulators want explanations. Only 47% of organizations have AI risk frameworks, and 70% lack ongoing monitoring. Strong governance, transparency, and continuous evaluation are essential to prevent accountability gaps and maintain regulatory compliance.

Legacy GRC and IT systems weren’t built for AI, making integration challenging. Poor data quality—messy, incomplete, or inconsistent—can lead to flawed AI decisions. Proper planning, robust data pipelines, and seamless system connectivity are crucial to ensure AI agents deliver reliable compliance outcomes and actionable insights.

These challenges aren’t insurmountable, but ignoring them is a recipe for disaster. Proper governance, oversight, and data hygiene are non-negotiable if AI agents for compliance are going to actually deliver value.

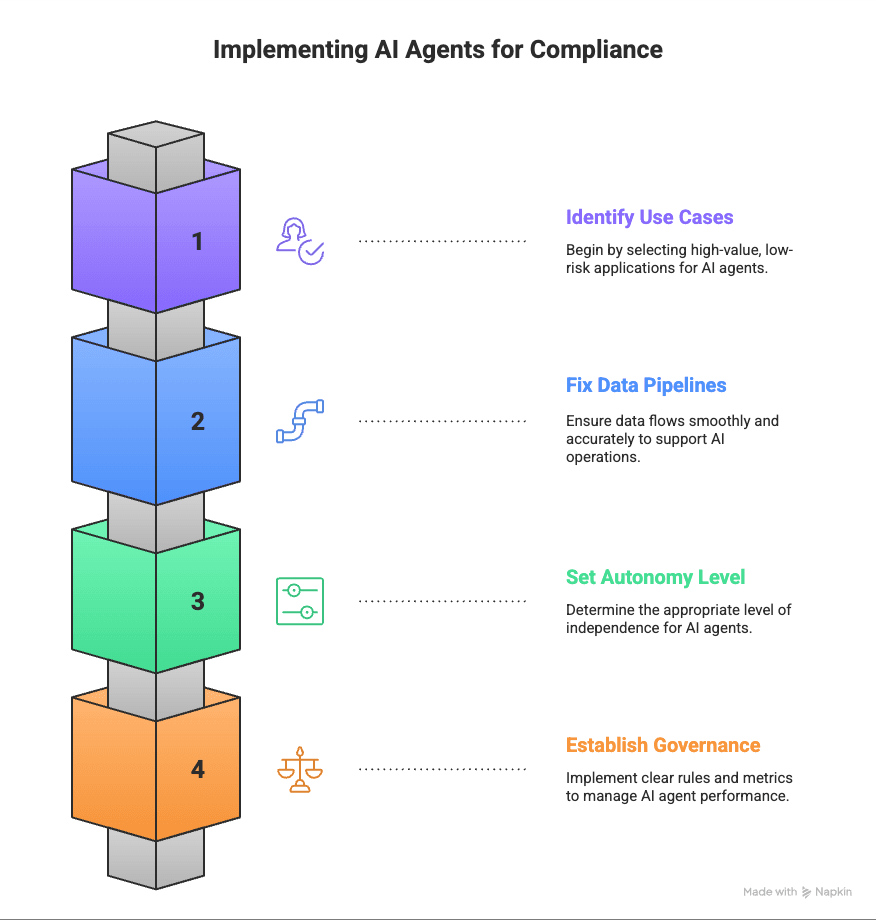

Ready to stop playing compliance whack-a-mole and actually get ahead of the game?

Here’s the truth: most AI compliance implementations fail because organizations try to boil the ocean on day one. Don’t be that company. Start smart, start small, and prove value fast.

These are practical steps for implementing agents effectively::

Let’s walk through each step—without hype or unnecessary complexity.

Start small, win big. That’s the mantra. Most successful organizations began with repetitive, time-consuming tasks that delivered quick wins.

Your best first targets:

Think of it like teaching a teenager to drive—you don’t start on the highway during rush hour.

Fancy AI is useless if your data is a mess. Nail the basics first:

Garbage in, garbage out isn’t just a saying—it’s a $3 million mistake waiting to happen.

Don’t hand a Formula 1 car to a new driver. Deploy semi-autonomous agents first:

Start small, keep humans in the loop, and let trust grow with each decision.

Most organizations already have AI use policies—be part of the smart majority. Set up guardrails:

Build guardrails, track what matters, and scale only when control is proven.

Implementing AI Agents for Compliance

Remember, the goal isn’t to replace your compliance team—it’s to make them superhuman. Plan carefully, start small, and scale smart. Your future self will thank you.

Here’s the deal: AI agents for compliance aren’t just improving—they’re becoming the strategic backbone for how smart organizations manage risk. The shift is already underway.

C-suite leaders who once treated compliance as a necessary evil now see automation as a secret weapon. Compliance teams are trading document shuffling for strategic advisory, and even regulators are exploring “regtech” for smarter oversight.

The path to AI-driven compliance is predictable: Augmentation—AI powers basic tasks, freeing humans for higher-value work. Collaboration—AI handles routine actions while humans focus on exceptions. Transformation—AI runs end-to-end workflows with humans steering strategic decisions.

The winners understand that AI agents aren’t just cost-cutters—they’re decision-quality enhancers. Data privacy, integration, and governance challenges are real, but proactive organizations tackle them head-on.

The future belongs to those who see AI agents for compliance automation as strategic partners. While competitors drown in manual processes and surprise audits, you’ll operate with machine precision and human-level strategy. The question isn’t if AI is reshaping compliance—it already is.

Struggling with compliance headaches? UprootSecurity is an agentic compliance platform that automates frameworks like SOC 2, ISO, GDPR, and HIPAA in hours—not days. Try it now and see the difference.

Senior Security Consultant